FxWirePro: EUR/JPY breaks major resistance at 125.95, targets 126.70

Mar 23, 2016 09:44 am UTC| Technicals

EUR/JPY has broken above strong trendline resistance at 125.95, could see test of 126.70. The slump yesterday was short lived and held the short term uptrend at 124.72 and the 20 day ma continues to hold on a closing...

FxWirePro: NZD/CAD sees strong support at 0.8778, short on breaks below

Mar 23, 2016 08:56 am UTC| Technicals

NZD/CAD is holding above strong trendline support at 0.8778, breaks below could see test of 0.8710. NZD/CAD weekly charts show that downtrend for the pair is intact and we see scope for tests of 85.85 in the...

FxWirePro:BTC/USD recovers after making a low of $403, good to sell on rallies

Mar 23, 2016 08:50 am UTC| Technicals

Major resistance - $436 (trend line joining $502.48 and $465) BTC/USD has recovered after making a low of $403. It is currently trading around $415. Short term trend is slightly weak as long as resistance $436...

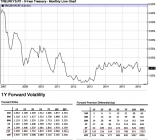

FxWirePro: US treasury forward vols and gamma seem better for hedging after FOMC

Mar 23, 2016 08:47 am UTC| Technicals

U.S.5Y treasury yield is flashing at 1.41% an increase from previous 1.38%, up about 2.61%. 14-day Real Strength - 55.11% 14-day Stochastic %K - 29.95% 14-day Stochastic %D - 35.61% With 5yT yields down 15bp on...

USD/CNY breaks key resistance at 6.4910, good to buy on dips

Mar 23, 2016 08:02 am UTC| Technicals

USDCNY is currently trading around 6.4953 levels. It made intraday high at 6.4955 and low at 6.4880 levels. Intraday bias remains bullish for the moment. A sustained break below 6.4910 will tests another...

Mar 23, 2016 07:27 am UTC| Technicals

As shown in the diagram, please be noted that the Vega of OTM strikes are at the highest positive levels along with higher vols. The premiums of ATM strikes are trading at around 14.13% more than NPV. We know that...

Mar 23, 2016 07:21 am UTC| Technicals

We begin with the reference of put options, hereinafter when we refer OTM or ATM strikes it is deemed as put options with OTM strike prices. Well, the implied volatility of ATM contracts are spiking from 11.65% in 1w...

- Market Data