FxWirePro- EURUSD Daily outlook

Mar 17, 2021 09:16 am UTC| Technicals

Ichimoku analysis (4 Hour chart) Tenken-Sen- 1.19172 Kijun-Sen- 1.19362 EURUSD is trading in a narrow range between 1.19884 and 1.18826 ahead of US Fed monetary policy. The central bank is expected to...

FxWirePro- USDCHF Daily Outlook

Mar 17, 2021 09:12 am UTC| Technicals

Ichimoku analysis (4-hour chart) Tenken-Sen- 0.92648 Kijun-Sen- 0.92779 USDCHF is trading flat for the past ten days and the intraday trend stays neutral. The pairs significant weakness can be seen only if it...

FxWirePro- GBPJPY Daily Outlook

Mar 17, 2021 08:01 am UTC| Technicals

Ichimoku Analysis (Hourly Chart) Tenken-Sen- 151.269 Kijun-Sen- 151.51 GBPJPY has recovered sharply after a minor dip below 200-H MA. The pair has halted its three days of losing streak on a minor jump...

FxWirePro: WTI pauses 3 straight session's of downside, holds above $65/barrel mark

Mar 17, 2021 06:33 am UTC| Technicals

USOIL chart - Trading View WTI Crude oil prices retrace above the $65/barrel mark, pause 3 straight sessions of weakness. Oil prices are likely extending the previous sessions rebound from multi-day lows, but gains...

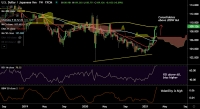

FxWirePro: USD/JPY holds marginal gains ahead of Fed policy meet

Mar 17, 2021 06:20 am UTC| Technicals

USD/JPY chart - Trading View USD/JPY was trading marginally higher at 109.13 at around 05:30 GMT, bulls hold-off from placing aggressive bets ahead of FOMC meet. USD bulls ignore Tuesdays disappointing US monthly...

Mar 17, 2021 04:52 am UTC| Technicals

Ichimoku analysis (Hourly chart) Tenken-Sen- $1732 Kijun-Sen- $1733 Gold is consolidating in a narrow range between $1721.70 and $1741.70 for the past two days ahead of the FOMC meeting. The central bank is...

FxWirePro: AUD/USD rangebound below 21-EMA in pre-Fed trading lull

Mar 17, 2021 04:18 am UTC| Technicals

AUD/USD chart - Trading View AUD/USD was trading largely rangebound in the Asian session as caution prevails ahead of FOMC meet. The pair made a session high of 0.7747 and low of 0.7723 and upside remains capped...

- Market Data