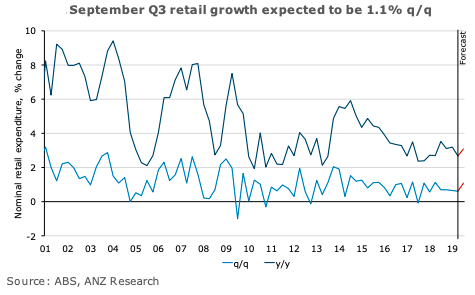

Australia’s Q3 2019 retail data is due out on Monday, November 4; it is expected to increase by 1.1 percent q/q, including 0.4 percent volume growth and 0.7 percent price growth. September is expected to do the quarter’s heavy lifting in monthly nominal growth, with 0.7 percent m/m growth, according to the latest report from ANZ Research.

Food prices are behind the strong price growth; while modest volume growth shows the improvement tax and rate cuts produced compared to the Q2 outcome, offset by the ongoing impediments to spending of high debt, flat wages and increased living costs.

Price growth is likely to moderate a little in Q3 compared to Q2 (0.7 percent q/q Q3 vs 0.8 percent Q2), but none-the-less expect annual price growth is expected to be the highest year-on-year result since Q2 2009 at 2.6 percent, the report added.

The increase in prices of essentials like food, utilities, education and health creates a hurdle for improving retail volumes. Flat wages and high household debt are constraining household budgets, forcing many households to delay bigger-ticket purchases such as furniture and appliances.

The recent downturn in retail spending has been particularly painful for these categories, with the drop in housing turnover also contributing.

While this year’s tax cuts this year did not produce a spike in August spending, they did coincide with a change in spending patterns. Recreation goods, fashion and department stores grew at rates well above their two-year averages.

While tax cuts don’t appear to completely offset other barriers to discretionary spending, we expect an ongoing modest lift in discretionary categories as they filter through to household budgets. The slight movement away from food towards non-food items as a result of tax cuts is a positive for Q3 volume expectations, ANZ Research further noted in the report.

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom