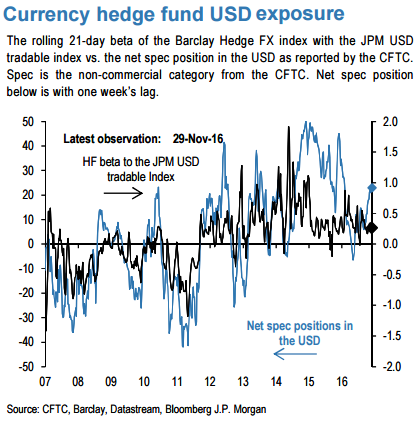

The above performance picture, we get from the monthly reporting hedge funds is quite disappointing than the picture from the daily reporting funds as even currency hedge funds performed poorly in November.

As you could observe the rolling 21-day beta of the Barclay Hedge FX index with the JPM USD tradable index vs. the net spec position in the USD as reported by the CFTC. Spec is the non-commercial category from the CFTC. Net spec position below is with one week’s lag.

Fed package: The FOMC proved more hawkish than markets anticipated, with the dots shifting to reflect a total of three hikes during 2017. This hawkishness helped to mitigate some of the underperformance of treasury yields such as ZAR 10-year payer trades, as rates were paid up across emerging markets while EM currencies deteriorated.

Over the near term, some positive political dynamics and technical forces may continue to bolster ZAR resilience. Domestic and external factors point in divergent directions, underscoring the importance of trade entry levels.

ECB’s shift: An ECB tapering scenario by 2018, our house view, creates a big demand cliff for global bond markets in 2018, unless supply collapses at the same pace as demand, which seems rather unlikely, or demand outside G4 central banks picks up quickly, something that is more likely to happen only after a big increase in bond yields. An alternative scenario where the ECB tries to preserve ammunition would prolong QE to beyond 2018.

A smoother QE reduction profile is also important because this week’s ECB decision involved not only a reduction in the pace of purchases but also a shift in purchases towards shorter maturities which implies less duration withdrawal.

The USD surged higher, aligned with US yields on the back of the Fed not only raising rates by the expected 25bps, but increasing their expectations for three more hikes next year, from two. They expect jobs growth to strengthen further and inflation to pick up towards their 2% target.

As a result, Long-term the move down through the 1.0450 region is arguably the last in the cycle from the 1.6020 highs set back in 2008. If this is the case the market should not breakdown through the 1.01-0.99 region. Such a move would expose a deeper rift in the EUR and risk a move towards 0.90.

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge