The Aussie dollar underperformed in the weeks of broad US dollar strength following the FOMC and ECB mid-June meetings but so far in July, it has been near the middle of the G10 pack.

On the flips side, the USD had been on the defensive for much of the first two trading sessions this week ahead of Fed (that is scheduled today, potentially month-end flow related). But, that dynamic shifted overnight as speculation rose that President Trump may threaten to increase tariffs on $200bn worth of Chinese imports from 10% to 25%.

Weighing on AUD factor have been a pullback in major commodity prices, metals in particular, investor apprehensions over US-China trade turmoil and the Fed's ongoing optimism on the US economy.

OTC outlook and Options Strategy:

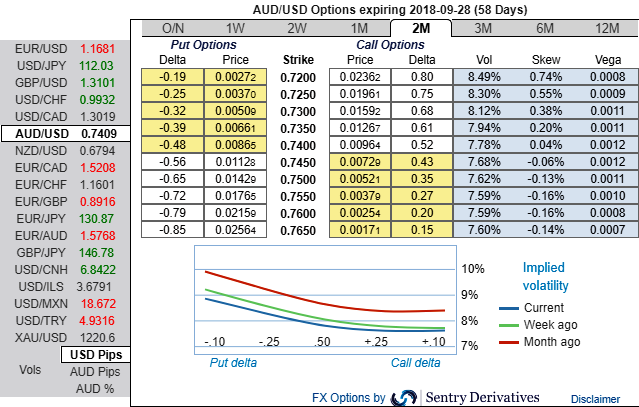

Please be noted that the positively skewed IVs of 2m tenors signify the hedgers’ interests to bid OTM put strikes upto 0.72 levels (above nutshell). While we see the mild positive shift in bearish delta risk reversal indicates that the hedging activities for the downside risks remain intact amid mild momentary upswings.

Accordingly, diagonal put ratio back spreads were advocated a couple of days ago, wherein short leg is functioning as the underlying spot FX keeps spiking, we would like to uphold the same strategy on hedging grounds.

Both the speculators and hedgers for bearish risks are advised to capitalize on the prevailing price rallies and bidding theta shorts in short run and 3m risks reversals to optimally utilize Vega longs.

On hedging grounds, fresh delta longs for long-term hedging, more number of longs comprising of ITM instruments and theta shorts in short-term would optimize the strategy.

So, the execution of hedging positions goes this way:

Short 1m (1%) OTM put option with positive theta (position seems good even if the underlying spot go either sideways or spike mildly), simultaneously, go long in 2 lots of vega long in 3m (2%) ITM -0.79 delta put options. A move towards the ATM territory increases the Vega, Gamma and Delta which boosts premium.

Deep in the money call with a very strong delta will move in tandem with the underlying.

Thereby, the above positions address both upswings that are prevailing in the short run and bearish risks in long run by vega longs.

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards -78 levels (which is bearish), while hourly USD spot index was at 8 (neutral) while articulating (at 08:05 GMT). For more details on the index, please refer below weblink:

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says