Federal Reserve and Bank of Japan are the two G7 central banks scheduled for their monetary policies this week and for the next week. Ahead of the Fed tomorrow, the US yields have taken back some of last week’s strong rise, seeing USDJPY reverse sharply from 110 to 108 again, while the broader USD looks like it could develop a stronger corrective rebound.

We expect the yen to remain weak as the corona crisis continues to ebb. But the depreciation potential is limited, since the BoJ's expansionary measures, which are far less aggressive than those of other central banks, are dampening the inflation outlook.

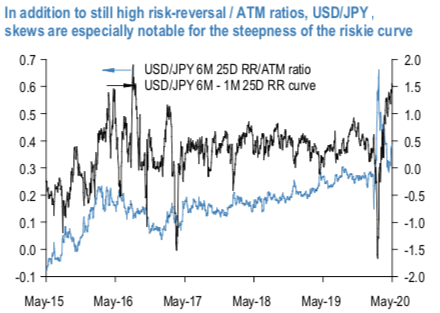

USDJPY is no exception to the general theme of rich risk-reversals relative to ATM vols across G7 surfaces; the Yen skew curve also screens extremely steep. We flagged the elevated RR/ATM ratio set-up last week as a key rationale for initiating a delta-hedged ratio USDJPY put spread to scalp smile theta, a structure that also dovetails with our Yen strategists' view of gradual currency strength in coming months as Japan’s post-COVID-19 return to deflation amid tame BoJ easing relative to the Fed increases JPY’s real yield edge over USD. A related notable observation regarding JPY skews is the extreme steepness of the risk-reversal curve (refer 1st chart), which renders the belly of the curve (6M) a relatively better location for medium-term skew shorts than shorter-expiries, and also has the happy side-effect of providing some insulation against erratic gamma spikes that can never be ruled out in the current virus-infected and politically fraught market environment.

No discussion of Yen options today can be complete without highlighting the dramatic collapse of front-end vols; USDJPY put spreads/ digitals are at all-time lows in premium. The 10% pt. peak-to-current decline in 3M USDJPY ATM vol over the past two months only has two historical precedents – the Asian Financial Crisis ‘97/’98 and GFC’08; the difference is that peak vol levels were materially higher on both occasions, though this does not render the current correction "wrong" as it comes on the heels of an equally spectacular crash in realized vol as well, with USDJPY spot tuck in a tight 106 – 108 range for much of the past two months. Per the strategic Yen view outlined above, we do not hold out great hope that this state of affairs will change anytime soon barring an unexpected shock on the US/China tensions front. But the steep risk- reversal /ATM ratio set-up that such a collapse in vols has spawned is responsible for depressing prices of USD put/JPY call spread and digital options to the lowest on record (refer 2nd chart). Macro investors looking to position for a multi-month grind lower in USDJPY or portfolio hedgers looking for low-premium Yen protection could do worse than buying such highly geared, limited upside structures. Courtesy: JPM

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms