Amid the overhang from global trade tensions, the dollar fell against the EUR, GBP, and CHF as rhetoric out of China (from the Commerce Ministry on Friday) grew increasingly strident. Note however that the cyclical closed largely flat against the USD and trailed their G10 peers.

This week, FOMC minutes are due on Wednesday while Fed appearances are penciled in from Tuesday to Friday. On this front, watch for further Fed rhetoric with respect to the potential deleterious effects of a global trade war, with the attendant tempering of rate hike projections.

The currency markets navigated two major events over the past week that left the broad dollar with no more directional clarity than before. The March FOMC under new Fed Chair Powell raised rates as widely anticipated and forecast an additional one-and-a-half rate hikes by the end of 2020, but any hawkish fallout for the dollar was contained by and the back-loaded nature of projected rate increases and only a marginal upward revision to the implied neutral real rate relative to the December’17 SEP.

Any designs of re-loading USD-funded carry trades on this relatively benign FOMC outcome, especially given the recent spate of soft-side US inflation prints that had allayed fears of a behind-the-curve Fed, were however frustrated by the announcement of US trade actions following the findings of the Section 301 China/IP investigation that hit equities harder than anticipated.

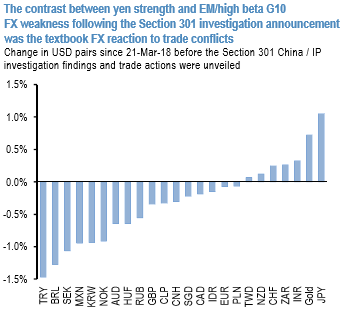

The 3%+ tumble in SPX after the release led to predictably sharp rallies in JPY and gold and declines in EM and high-beta G10 (refer 1st chart), and validated our trade protectionism template of decoupling between reserve and non-reserve FX that we have frequently cited in these pages.

The trades portfolio has run relatively light on risk in recent weeks, with a slight defensive lean predicated on navigating the uncertainty of potentially disruptive US trade policy. This has helped sidestep head fakes in risk markets such as that following benign US CPI, but has also missed participating in the extension of the yen rally after taking profits on AUDJPY shorts (in hindsight) too early around the VIX shock.

Having been sidelined in the yen since then in anticipation of a seasonal uptick in unhedged Japanese outflows in the new fiscal year, we are cautious about chasing USDJPY lower from current levels, especially without the tailwind of broader dollar weakness.

Long reserve FX exposure is instead focused in two of the relative laggards – EUR and CHF – via longs in EUR/antipodean crosses and a short in USDCHF that eked out only workmanlike gains over the past week but offer potentially more durable returns on divergent monetary policy cycles even if trade tensions ebb. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data