Taiwan’s export orders remained weak during the month of March on an annual basis, but sequential data showed some improvement both at the headline level and in the electronics and infocomm product segments; however, some stabilisation and recovery in the near term is expected, albeit at a gradual pace, according to the latest report from ANZ Research.

On a seasonally adjusted basis, we estimate that overall export orders increased by 1.4 percent m/m whereas that for electronics and infocomm product segments increased by 7.1 percent m/m and 6.6 percent m/m, respectively.

Even though absolute levels for both product segments remain lower than the Q4 2018 average and in January 2019, the improvement is encouraging. The MOEA has forecast that export orders in April 2019 would range between USD35.5 billion to USD36.5 billion, implying a y/y decline of 6.7 percent to 9.2 percent y/y.

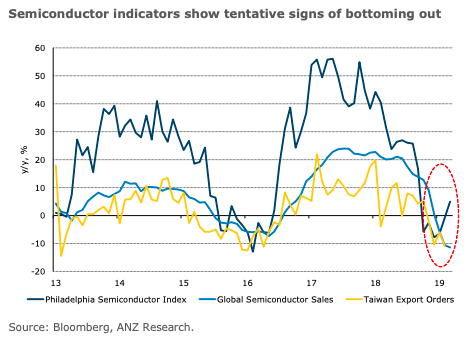

The forecast appears broadly consistent with the 8.7 percent y/y fall in South Korea’s exports over the first 20 days of April. As such, the slump in global sales of semi-conductors has continued. In March, sales declined 11.4 percent y/y, the report added.

On the other hand, the Philadelphia Semiconductor Stock Index, which has been a good leading indicator of semiconductor sales has strengthened indicating an imminent recovery.

"It is also important to bear in mind that the inventory-shipment in Taiwan has risen in recent months and therefore, an improvement in export orders will take time to translate into production," ANZ Research added in its comments.

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions