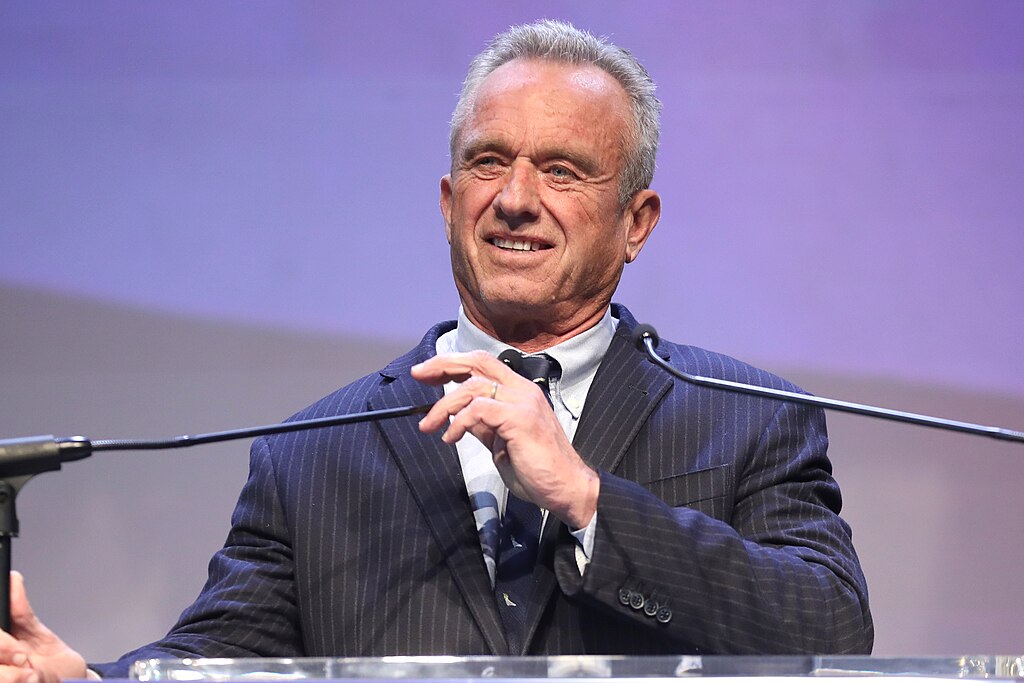

Sweeping changes to U.S. vaccine policy under Health Secretary Robert F. Kennedy Jr. are creating uncertainty across the pharmaceutical sector, dampening investor confidence and raising concerns among vaccine manufacturers. Since President Donald Trump’s administration reshaped federal health leadership, long-standing vaccine recommendations have been rolled back, marking a significant shift in public health strategy that is already affecting vaccine demand, company revenues, and long-term investment outlooks.

Over the past year, the U.S. has ended broad guidance that previously recommended routine childhood immunizations for illnesses such as influenza and hepatitis A. Additional changes include scaling back COVID-19 vaccine recommendations for pregnant women and children, altering childhood vaccine schedules, and replacing independent advisory panels with members more aligned with Kennedy’s long-held skepticism toward vaccines. These moves, which Kennedy says are aimed at improving safety and aligning U.S. policy with other nations, have alarmed public health experts and the biotech industry alike.

Investors and analysts note that vaccine makers now face increased political risk. Many initially viewed Kennedy’s appointment as a short-term headline issue, but as policy changes have translated into lower vaccination rates, the impact has become more tangible. Analysts warn that vaccines may no longer be seen as a reliable growth segment under the current administration, potentially weighing on the sector through at least 2028.

Major pharmaceutical companies such as GSK, Sanofi, Pfizer, and Merck are better positioned to absorb the impact due to diversified revenue streams. However, smaller vaccine-focused biotech firms like Moderna, BioNTech, and Novavax face heightened exposure. Recent earnings reports already show signs of strain, with lower U.S. flu vaccine sales reported despite a severe flu season. Outside the U.S., companies have also reacted to declining vaccination rates, citing increased volatility in the global vaccine market.

While many investors believe long-term demand for vaccines will recover—especially if disease outbreaks intensify—near-term uncertainty remains a drag on investment. Ongoing legal challenges from medical organizations and shifting public sentiment add further unpredictability. For now, changing U.S. vaccine policy and rising skepticism are reshaping the risk calculus for vaccine makers and investors, making the market less predictable than it has been in decades.

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  Sanofi Reports Positive Late-Stage Results for Amlitelimab in Eczema Treatment

Sanofi Reports Positive Late-Stage Results for Amlitelimab in Eczema Treatment  OpenAI Hires Former Meta and Apple AI Leader Ruomin Pang Amid Intensifying AI Talent War

OpenAI Hires Former Meta and Apple AI Leader Ruomin Pang Amid Intensifying AI Talent War  FERC Approves Blackstone Infrastructure’s Acquisition of TXNM Energy, Advancing Utility Merger

FERC Approves Blackstone Infrastructure’s Acquisition of TXNM Energy, Advancing Utility Merger  Novartis’ Vanrafia Shows Strong Phase 3 Results in IgA Nephropathy, Paving Way for Full Approval

Novartis’ Vanrafia Shows Strong Phase 3 Results in IgA Nephropathy, Paving Way for Full Approval  Flare, Xaman Roll Out One-Click DeFi Vault for XRP Yield via XRPL Wallets

Flare, Xaman Roll Out One-Click DeFi Vault for XRP Yield via XRPL Wallets  Venezuela Amnesty Law Frees Nearly 2,200 Prisoners, Says Jorge Arreaza

Venezuela Amnesty Law Frees Nearly 2,200 Prisoners, Says Jorge Arreaza  Ecuador Raises Tariffs on Colombian Imports to 50% Amid Border Security Dispute

Ecuador Raises Tariffs on Colombian Imports to 50% Amid Border Security Dispute  Trump Media Weighs Truth Social Spin-Off Amid $6B Fusion Energy Pivot

Trump Media Weighs Truth Social Spin-Off Amid $6B Fusion Energy Pivot  Paramount Skydance Forecasts Soft Q1 Revenue as Streaming Growth Counters Linear TV Decline

Paramount Skydance Forecasts Soft Q1 Revenue as Streaming Growth Counters Linear TV Decline  Toyota Plans $19 Billion Share Sale in Major Corporate Governance Reform Move

Toyota Plans $19 Billion Share Sale in Major Corporate Governance Reform Move  Paramount Skydance to Acquire Warner Bros Discovery in $110 Billion Media Mega-Deal

Paramount Skydance to Acquire Warner Bros Discovery in $110 Billion Media Mega-Deal  Innovent Biologics Shares Rally on New Eli Lilly Oncology and Immunology Deal

Innovent Biologics Shares Rally on New Eli Lilly Oncology and Immunology Deal  Hyundai Motor Group to Invest $6.26 Billion in AI Data Center, Robotics and Renewable Energy Projects in South Korea

Hyundai Motor Group to Invest $6.26 Billion in AI Data Center, Robotics and Renewable Energy Projects in South Korea  Panama Investigates CK Hutchison’s Port Unit After Court Voids Canal Contracts

Panama Investigates CK Hutchison’s Port Unit After Court Voids Canal Contracts