Jan 19, 2018 13:08 pm UTC| Research & Analysis Insights & Views Central Banks

Before we emphasize anything much on this write-up, we urge you to go through our previous post this pair which is available on below...

Jan 19, 2018 08:07 am UTC| Commentary Central Banks Economy

The Bank of Japan (BoJ) is expected to maintain its QQE with yield curve control policy unchanged at the next monetary policy meeting ending on Tuesday, January 23. Governor Kuroda is further, likely to downplay the...

FxWirePro: The Day Ahead- 19th January 2018

Jan 19, 2018 05:35 am UTC| Commentary Central Banks

Lots of economic data and events scheduled for today, and some with high volatility risks associated. Upcoming: Germany: producer price inflation report will be released at 7:00 GMT, for the month of...

Bank Indonesia keeps interest rate unchanged at 4.25 pct, likely to keep rate on hold through 2018

Jan 18, 2018 17:31 pm UTC| Commentary Central Banks

The Indonesian central bank, Bank Indonesia stood pat in January. BI kept the policy rate on hold at 4.25 percent, with a neutral policy stance. On the economy, the Bank Indonesia kept its growth projection for 2017...

Bank of Korea keeps interest rate on hold in January

Jan 18, 2018 14:23 pm UTC| Commentary Central Banks

The South Korean central bank kept its key interest rate on hold during its meeting today. The policy rate was kept unchanged at 1.5 percent, as was expected. Given that the economy is on a strong footing, there is...

CBRT stands pat in January, to maintain tight monetary policy stance

Jan 18, 2018 13:45 pm UTC| Commentary Central Banks

The Central Bank of Turkeys Monetary Policy Committee stood pat during its meeting today. The committee decided to keep the short term interest rates on hold. The Marginal Funding Rate was kept at 9.25 percent and the...

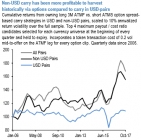

FxWirePro: ATMF vs ATMS call spreads into dual EMFX pairs

Jan 18, 2018 09:47 am UTC| Research & Analysis Central Banks Insights & Views

As USDCNY breached a key support at 6.4772 levels recently, the market seems to be curious whether Chinese central bank would step up an effort to prevent its currency from appreciating too drastically. China, with a...

- Market Data