ECB likely to revise its optimistic views of a sizeable recovery

Oct 30, 2015 06:15 am UTC| Commentary Central Banks

Resilient Euro economy in the near term, but the lending channel is not working. The flow of data over the past two weeks has proven better than expected. The euro area continues to show resilience, helped by robust...

Likelihood of ECB's December action rising

Oct 30, 2015 06:06 am UTC| Commentary Central Banks

Last week after the ECB meeting, a December move was seen as less likely, but still very possible, than a March 2016 move. A series of developments (dovish tone from ECB board members, weakness in credit dynamics, Fed...

Mexico monetary policy on hold, inflation should be close to 3% in 2016

Oct 29, 2015 21:03 pm UTC| Commentary Economy Central Banks

Banxico decided to maintain the reference rate at 3.00% as expected. The press release highlights that the balance of risks to growth has worsen since the previous meeting while the inflation outlook remains the same,...

Russia’s central bank to cut the key rate by 50bp

Oct 29, 2015 20:49 pm UTC| Commentary Central Banks

Russias central bank (the CBR) will announce its monetary policy decision this friday at 11.30 CET. The key rate is expected to be lowered by 50bp to 10.50%, while consensus is split between a 50bp cut and no change. It is...

ECB meeting: Dovish tone from ECB board members

Oct 29, 2015 20:33 pm UTC| Commentary Central Banks

After the press conference held by president Draghi, who has a good track record of being ahead of the market, ECB board members (Praet, Constancio, Coeuré) signalled significant dovishness, indicating that the ECB...

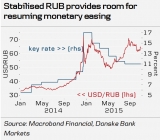

CBR rate decision preview: time to resume easing

Oct 29, 2015 15:22 pm UTC| Commentary Central Banks

This Friday (30 October 2015) at 11:30 CET Russias central bank (the CBR) will announce its monetary policy decision. Economists expect the key rate to be lowered by 50bp to 10.50%, while consensus is split between a 50bp...

“Don’t fight the Fed” expanded to all central banks

Oct 29, 2015 14:50 pm UTC| Commentary Central Banks

The Fed met expectations by not raising rates and setting off a global market rally. Tomorrow the Bank of Japan has its turns at additional monetary stimulus. The ECB already signaled intentions in December for more...

- Market Data