RBA monetary policy – assessing the bias

Nov 03, 2015 08:35 am UTC| Insights & Views Central Banks

Reserve Bank of Australia (RBA) decided today to keep its monetary policy steady with interest rates at 2% against some expectations in the market for further easing. Though the central bank may have kept the options...

ECB increasing QE purchases, easier said than done

Nov 03, 2015 06:23 am UTC| Commentary Central Banks

The two options of extending or expanding QE purchases seem nice and easy, but the issue limit could eventually become an issue for the ECB. This is already a problem with the 60bn purchases per month, why ECB raised the...

BoE's first rate hike likely in H1 16

Nov 03, 2015 06:22 am UTC| Commentary Central Banks

After a strong start to the year, the U.K. economy is advancing at a moderately less buoyant pace, with real GDP growth decelerating to 0.5% q/q in the third quarter, down from a 0.7% advance in the prior quarter. U.K....

ECB QE programme's length extension unlikely to be a big surprise to the markets

Nov 03, 2015 05:47 am UTC| Commentary Central Banks

Given the latest decline in Euro areas inflation and as the programme is designed to run until there is a sustained adjustment in the path of inflation. An extension of QE for more than six months would likely be somewhat...

Flexibility under QE programme has many dimensions

Nov 03, 2015 05:13 am UTC| Commentary Central Banks

Draghi and a number of other ECB members have repeatedly argued for flexibility in the QE programme in terms of its size, composition and duration. Considering the current design of the QE programme, monetary policy easing...

ECB’s menu of instruments can be used to surprise markets

Nov 03, 2015 05:10 am UTC| Commentary Central Banks

The stance at the ECB meeting in October was surprisingly dovish, particularly as Draghi opened the door for further deposit rate cuts. Previously the message had been that the ECB had reached the lower bound on the...

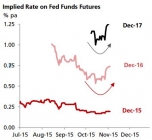

The ebb and flow of Fed hike expectations

Nov 03, 2015 02:44 am UTC| Commentary Central Banks

Over the past two weeks, market expectations of Fed normalization have rebounded somewhat. Much of this has got to do with the market interpreting the October FOMC outcome to be more hawkish than anticipated. Sensitivity...

- Market Data