Synchronized central bank stimulus sets off global market rally

Nov 03, 2015 15:11 pm UTC| Commentary Central Banks

Economists have seen this all before as fundamentals deteriorate, central banks act. It happened in third quarter 2012. With earnings growth expectations negative, the Federal Reserve stepped in with a third round of...

BoE preview: market pushed hikes too far

Nov 03, 2015 14:44 pm UTC| Commentary Central Banks

Economists expect a measured hawkish nudge from BoEs Quarterly Inflation Report (QIR)to be published on 5 November. There has not been enough downside news, for the BoE to justify the decline in market interest rate...

European markets to look for cues in Draghi’s speech today

Nov 03, 2015 12:51 pm UTC| Insights & Views Central Banks

Euro as well as European bond and stock markets will look for cues on further ECB action in todays scheduled speech by European Central Bank (ECB) president Mario Draghi. After raising the possibility of further ECB...

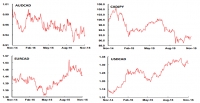

Consolidation in USD/CAD to extend further, higher U.S rates, lower oil prices to weigh

Nov 03, 2015 11:28 am UTC| Insights & Views Central Banks Technicals

The Bank of Canada in October held interest rates, but painted a gloomy picture of the Canadian economy. The BOC noted that weak oil prices have had a negative impact on the export sector and hurt economic growth. In its...

RBA leaves door to further rate cut wide open

Nov 03, 2015 08:48 am UTC| Commentary Central Banks

As the majority of analysts believed that the Australian central bank left its key rate unchanged at 2.00%. Overall it seemed quite optimistic as regards the Australian economy. There was particular reference to the...

Weak euro with nice side effects for ECB

Nov 03, 2015 08:43 am UTC| Commentary Central Banks

The euro has recovered notably since the spring and on a trade weighted basis it has now appreciated by approx. 4%. The data thus underlines why ECB President Mario Draghi is likely to be so keen for the euro to return to...

RBA monetary policy – assessing the bias

Nov 03, 2015 08:35 am UTC| Insights & Views Central Banks

Reserve Bank of Australia (RBA) decided today to keep its monetary policy steady with interest rates at 2% against some expectations in the market for further easing. Though the central bank may have kept the options...

- Market Data