Euro area money supply growth to remain buoyant

Sep 25, 2015 00:38 am UTC| Commentary

Euro area M3 money supply growth recovered from a lacklustre 1.1% yoy in May 2014 to a buoyant 5.3% in July 2015. The pattern of stabilisation in August is expected with a 5.2% yoy print, a slight drop from July but still...

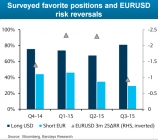

ECB the catalyst for a renewed push lower in the EUR

Sep 24, 2015 23:12 pm UTC| Commentary

The ECB is expected to step up its easing by year-end to revive the recent sharp drop in inflation expectations. It is expected to extend its time-based commitment to QE for 6-9 months. EURUSD is likely to depreciate both...

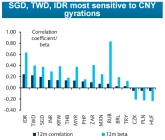

Impact of China’s FX policy on EM Asia FX

Sep 24, 2015 22:56 pm UTC| Commentary

Concerns about China growth, the competitiveness challenge and the potential disinflationary effect of CNY devaluation on import prices have all pushed EM FX weaker. Although a large share of Asias exports to China are...

Further BoJ easing is unlikely in the near term

Sep 24, 2015 22:42 pm UTC| Commentary

It is believed that further BoJ easing is unlikely in the near term. Additional easing is expected only in next April when the Bank faces its self-imposed deadline for 2% inflation and 2016 Shunto results become clearer....

EM central banks waiting for Fed

Sep 24, 2015 22:37 pm UTC| Commentary

Average headline inflation remained subdued in August, moving slightly higher to 4.6% YoY from 4.5% average in July. This brings average inflation for 3Q to 4.6%, down from 4.7% in 2Q. Core inflation also remained...

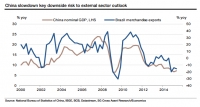

Continued slowdown in China could nullify the gains from the BRL depreciation

Sep 24, 2015 21:30 pm UTC| Commentary

In particular, Brazils export growth strongly depends on Chinese growth and the possibility of a further Chinese slowdown could nullify most of the gains from the real depreciation. It may be argued that the gains in the...

Bank of Israel decided to keep base rate on hold

Sep 24, 2015 21:23 pm UTC| Commentary Central Banks

The Bank of Israel (BoI) decided to keep its base rate on hold at 0.10%, in line with expectations. The BoI staff has lowered both its inflation and growth forecasts substantially since its June forecasts. Notwithstanding,...

- Market Data