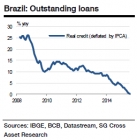

Brazil's real credit growth likely turned negative in July

Sep 22, 2015 07:23 am UTC| Commentary

After a brief pick-up in H2 14 on liquidity measures, Brazils credit growth resumed its decelerating trend. Credit growth shrunk below 10% in June but saw a modest uptick in July as business credit posted the best yoy gain...

Emerging Asia's central banks likely to be on hold

Sep 22, 2015 07:14 am UTC| Commentary

The NBH announced the end of the cut cycle two months ago, and even though inflation has dropped and growth has slowed, it is too soon to consider further cuts. In EMEA, CBT is expected to remain on hold. Also, Hungary,...

Central Bank of Turkey likely to be on hold

Sep 22, 2015 07:10 am UTC| Commentary

In EMEA, many rate decisions would be released next week. The most interesting will be the Turkey MPC meeting. The CBT is expected to remain on hold next week. The CBT announced its roadmap for the simplification of the...

Further deterioration likely in Brazil's employment

Sep 22, 2015 07:04 am UTC| Commentary

The inaction of Brazil government continues taking its toll on Brazilian assets. Any meaningful change is unlikely, risk premia is expected to remain elevated until there is more clarity on how the fiscal situation is...

Fed focus to restore dollar driving power

Sep 22, 2015 07:01 am UTC| Commentary

An important shifts in FX and cross-asset correlations is observed in past two months. The FX volatility market still discounts a negative implied correlation, though it is very low on an historical basis. The Fed still...

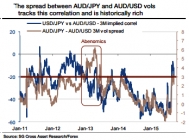

JPY and AUD volatilities suggest intensifying correlations

Sep 22, 2015 06:49 am UTC| Commentary

Individual volatilities suggest that the correlation between AUD and JPY should intensify. The implied correlation between USD/JPY and AUD/USD is well approximated by the spread between AUD/JPY and AUD/USD implied...

Banxico probably sees no reasons to hike

Sep 22, 2015 06:47 am UTC| Commentary

Banxico is likely to remain on hold as the Fed delays its lift-off and the global and local economic outlook actually points to easier monetary conditions. Banxico might not probably not follow the path implied by the...

- Market Data