FxWirePro: FVAs in USD/BRL as vols turning lower in H1 2016

Jan 19, 2016 14:25 pm UTC| Insights & Views

Short 6M in 1Y time FVAs in USD/BRL: Since Funding valuation adjustment is essentially the funding cost/benefit resulting from borrowing or lending the shortfall/excess of cash arising from day-to-day derivatives business...

Jan 19, 2016 13:14 pm UTC| Insights & Views

Its a green day for euro, almost all economic figures that drive euro are printed into positive data.Lets begin with German ZEW that signifies institutional investors sentiments towards euro areas economic sentiments,...

PBoC determined to stop further CNY and CNH depreciation, RRR no likely coincidence

Jan 19, 2016 11:53 am UTC| Insights & Views

China stepped up its efforts further overnight to stop the CNY and CNH depreciation. On Monday, the central bank announced a new move to impose the reserve requirement ratio on some foreign banks from January 25, which...

Jan 19, 2016 10:58 am UTC| Insights & Views

EURAUD in retracement mood as it has formed Bearish Gartley" on daily charts.We began this week with day high rejection at 1.4968 (day open highs of yesterday) after rejecting last weeks highs of 1.6076 (completion of CD...

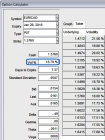

FxWirePro: EUR/CAD seems to be edgy, deploy option strips for hedging and speculating

Jan 19, 2016 09:13 am UTC| Insights & Views

This weeks monetary policy decision from central banks of euro area and Canada is most likely to bring in more volatility (see diagram for ATM IVs of 18.79%).This Thursday ECB President Draghi faces a tough task curbing...

What could hamper Euro ahead of ECB meeting, BoC edgy and crude continues stress on CAD?

Jan 19, 2016 09:08 am UTC| Insights & Views

ECB President Draghi faces a tough task curbing the appeal of the single currency. CAD short positioning is showing signs of exhaustion.The euro jump in recent trend is major due to the massive price drops in crude prices...

Jan 19, 2016 05:57 am UTC| Insights & Views

NZD should weaken again on rate compression from both sides as the Fed hikes and RBNZ eases another 50bp (only 25bp is priced).The newer theme is material deterioration in the current account deficit from -3.5% to -6% or...

- Market Data