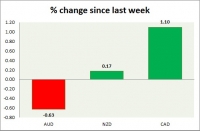

Currency snapshot (commodity pairs)

Aug 12, 2015 16:30 pm UTC| Insights & Views

Dollar index trading at 96.05 (-1.18%) Strength meter (today so far) - Aussie +0.82%, Kiwi +1.27%, Loonie +0.85%. Strength meter (since last week) - Aussie -1.71%, Kiwi -1.28%, Loonie +0.02%. AUD/USD - Trading at...

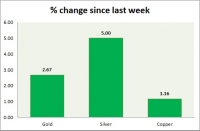

Commodities snapshot (precious & industrial)

Aug 12, 2015 16:20 pm UTC| Insights & Views

Metals are positive today. Performance this week at a glance in chart table - Gold - Golds broke above $1120 area. Todays range - $1001-$1126. Gold is likely to reach as high as $1150 area if support around $1180...

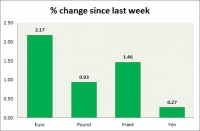

Currency snapshot (major pairs)

Aug 12, 2015 16:07 pm UTC| Insights & Views

Dollar index trading at 95.97 (-1.27%). Strength meter (today so far) - Euro +1.43%, Franc +1.92%, Yen +1.00%, GBP +0.35% Strength meter (since last week) - Euro +2.17%, Franc +1.46%, Yen +0.27%, GBP +0.93% EUR/USD...

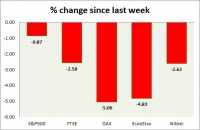

Aug 12, 2015 15:49 pm UTC| Insights & Views

Another devaluation from China soured equities. Performance this week at a glance in chart table - SP 500 - SP sharply down further today due to sell offs over Chinas action to devalue currencies for second...

Aug 12, 2015 14:48 pm UTC| Insights & Views

Gold is shining brighter among commodities on second day of Chinese devaluation of Yuan, weaken dollar. Investors feared that slowdown in China will have considerable impact on FEDs policy decision on rate hikes and might...

Bank of England rate hike next year likely to face Brexit Challenges

Aug 12, 2015 14:12 pm UTC| Insights & Views

Upbeat Bank of England (BOE), which is planning to hike rates or atleast intensely debate over that at turn of the year is likely to face challenges of possibilities of Brexit, UKs exit from European Union. Prime...

API reports deficit, while crude awaits EIA report

Aug 12, 2015 13:46 pm UTC| Insights & Views

Crude oil jumped back, after initial loss over Chinese devaluation of Yuan/Dollar exchange rate. As of now, WTI benchmark is up around 1%, trading at $43.5/barrel. Todays comeback can be contributed to four factors...

- Market Data