Dollar freeze gains suspecting on data release

May 15, 2015 08:46 am UTC| Insights & Views

In the US, streets will still carry on to absorb the recent data releases to evaluate projections of a rebound in economic growth in Q2 and now some more in the row. Yes indeed it would IP, empire state MI and consumer...

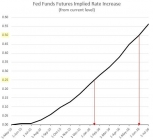

FED fund future says no hike this year

May 15, 2015 08:12 am UTC| Insights & Views

Rate hike expectations have shifted considerably with relatively dovish commentary from FED policymakers and weaker than expected economic releases from US. As of now market is predicting first rate hike of 25 basis...

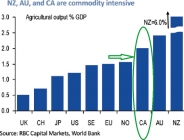

Canada’s factory sales likely to stimulate CAD’s ‘Bull Run’, hedge forex risk using CRS

May 15, 2015 07:55 am UTC| Insights & Views

Manufacturing shipments: Today a factory sales figure of Canada is scheduled to be released. Its a leading economic indicator that shows how quickly manufacturers are affected by market conditions and the prospect of...

Look at inflation and stop talking taper

May 15, 2015 07:20 am UTC| Insights & Views

It has been little more than two months, European Central Bank (ECB) started its massive 1.1 trillion asset purchase program and market participants are already talking taper. We have been warning against such talks as...

Swiss franc eyes on monthly PPI number

May 15, 2015 06:47 am UTC| Insights & Views

Aprils PPI: It is scheduled to announce the MoM PPI for April today. It going to be crucial factor for CHF as it measures the average change in price of goods and services sold by manufacturers and producers in the...

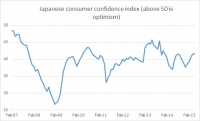

BOJ governor Kuroda is confident, consumers are not

May 15, 2015 06:22 am UTC| Insights & Views

Today in his speech Bank of japan (BOJ) governor Haruhiko Kuroda sounded pretty optimistic about Japanese economy and BOJs inflation target of 2%. According to him, Companies price and wage setting behavior have changed...

Guide to today’s important data and events

May 15, 2015 05:40 am UTC| Insights & Views

Not many economic dockets for today. Focus is on US data. Data released so far - Japan - Consumer confidence for April dropped to 41.5 from prior 41.7 Upcoming - Switzerland - Producer and import prices for April...

- Market Data