Sep 29, 2017 09:37 am UTC| Central Banks Research & Analysis Insights & Views

This write-up is just anattempt of routing trade flows in theright direction rather than having speculative moves that blow-out-of-the proportion due to the recent significant data flows from the central banks. The Fed...

Sep 29, 2017 07:27 am UTC| Research & Analysis Central Banks Insights & Views

For now, we all know that the dollar getting some traction, in response to Janet Yellens hawkish rhetoric while delivering speech at the NABE annual conference. Its was up by no more than 0.5% against any currency. The Fed...

Moody's: China home prices cool further in face of continued regulatory measures

Sep 29, 2017 03:28 am UTC| Research & Analysis

Moodys Investors Service says that Chinas residential property prices have cooled further in view of the implementation of tight controls in major cities since September 2016 aimed at curbing price rises by dampening...

Moody's: Philippine banking system stable, despite rapid loan growth

Sep 29, 2017 01:50 am UTC| Research & Analysis

Moodys Investors Service says that the outlook for the Philippine banking system is stable over the next 12-18 months and reflects the banks good asset performance, strong loss buffers and ample liquidity capacity -...

Sep 28, 2017 12:35 pm UTC| Research & Analysis Insights & Views Central Banks

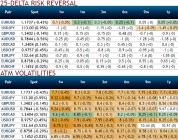

Before we proceed through the core part of this write up, lets have a glance through the implied volatilities of EURCHF ATM contracts from the above nutshell, IVs of this underlying pair of all expiries have still been the...

Sep 28, 2017 12:15 pm UTC| Research & Analysis Insights & Views

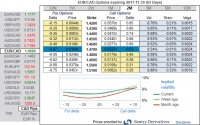

Contemplating the recent fundamental, technical and OTC developments, weve devised options strategy for EURCAD on hedging grounds. Mechanics: Buy EURCAD 2m ladder, strikes 1.4080/1.4678/1.4988 (we wouldnt like to be...

FxWirePro: Global central banks’ policy shift and frontiers on VXY valuations

Sep 28, 2017 10:57 am UTC| Central Banks Research & Analysis Insights & Views

The Fed was far from the only monetary policy game in town this week, and FX markets were as much driven by an ongoing repricing of BoE, policy rhetoric surprises in NOK, JPY, and to a lesser extent AUD. Rather than a...

- Market Data