FxWirePro: Low vol environment in G10 seems good but beware of indigestion

Jun 30, 2017 05:52 am UTC| Research & Analysis Insights & Views

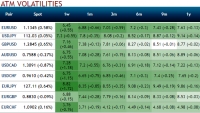

Please be noted that the above nutshell showing ATM IVs of G10 FX space is sensing the lower volatile environment. The first half of 2017 turned out to be one dominated by USD weakness, and the outperformance of EM...

FxWirePro: Cost-effective optionality structure to arrest a RUB correction

Jun 29, 2017 12:43 pm UTC| Research & Analysis Central Banks Insights & Views

The CBR remains s dovish. We expect the measured pace of rate cuts beginning in June. May CPI at 4.1% oya surprised on the upside and is marginally above the inflation target of 4.0%. As our base case, JPM forecasts the...

Jun 29, 2017 11:30 am UTC| Central Banks Research & Analysis Insights & Views

Economic activity continues to come in line with expectations and Chinese growth has stabilized. Going deeper into the year, however, we see Chinese demand sequentially declining, thus putting pressure on industrial...

Jun 29, 2017 08:08 am UTC| Research & Analysis Insights & Views

In our recent technical write-up, weve explicitly stated that the AUDNZD to keep inching higher in short run but major downtrend remains intact. For more details, visit below...

Jun 29, 2017 06:40 am UTC| Central Banks Research & Analysis Insights & Views

From a central bank perspective, the RBA continues to keep the faith in the 3% growth story for Australia. In its most recent communication, the RBA acknowledged the likely softness in 1Q GDP but refrained from reading too...

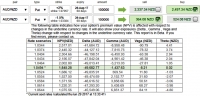

FxWirePro: Policy-induced trembles in EMFX – Play long gamma in G10 FX space via calendar spreads

Jun 28, 2017 12:53 pm UTC| Research & Analysis Insights & Views

FX vols enter H2 meaningfully cheap versus macro drivers and should mean-revert moderately higher. A U- rather than a V-shaped rebound is consistent with past vol cycles and mixed carry trade positioning. Steep vol curves...

Jun 28, 2017 12:09 pm UTC| Research & Analysis Insights & Views

Macro outlook: The near-term outlook for sterling is murky given that there are several factors likely to pull the currency in offsetting directions. The positives include: i) The possibility of a more conciliatory...

- Market Data