FxWirePro: What matters for choppy euro appreciation? RVs, IVs and skews to bid for OTM call strikes

Jun 14, 2017 08:10 am UTC| Research & Analysis Insights & Views

As the FX markets focus returns to monetary policy, its relationship with interest rates will become more prominent. The last time that FX vol was durably in a low regime coincided with a period when central bank policies...

FxWirePro: Bullish and bearish scenarios, OTC indications and hedging solutions of USD/JPY

Jun 14, 2017 07:26 am UTC| Research & Analysis Insights & Views

Bearish: USD/JPY to 125 if 1) The strong US growth leads aggressive Fed hikes and a spike in UST yields, resulting in broad USD strength, 2) The Japanese governments fiscal policy becomes more expansionary and the...

FxWirePro: Why do Loonie seem vulnerable? Cover USD/CAD exposure risks with covered call strategy

Jun 13, 2017 13:10 pm UTC| Research & Analysis Insights & Views

Last Friday, the front end of the Canadian rates market priced a 30% chance that rates would go up this year. One speech from BOC Senior Deputy-Governor Carolyn Wilkins later, and pricing is over 50%. She cited broadening...

FxWirePro: Strategic derivatives trades in global equities and FX space in H2’2017

Jun 13, 2017 12:54 pm UTC| Research & Analysis Insights & Views

In the US, despite the good economic backdrop, equity volatility has moved into oversold territory, and we illustrate this with a number of examples including an analysis of the business cycle. We advise caution in the...

FxWirePro: Cost-effective optionality structure to arrest RUB correction

Jun 13, 2017 10:52 am UTC| Research & Analysis Insights & Views

We turn bearish in RUB on the concern of commodity headwind and seasonally weaker current account outlook over the summer. We are more cautious of the commodity exporter, as terms of trade are unlikely to be favorable for...

FxWirePro: Beware of RUB correction and fetch benefits of high skew

Jun 13, 2017 09:55 am UTC| Research & Analysis Insights & Views

Please be noted that the IVs of RUB are the highest among G20 currency space. The volatility parameters favor structures that sell topside skew to cheapen up bullish USDRUB exposure. Being long USDRUB is a good hedge for a...

Jun 13, 2017 07:54 am UTC| Research & Analysis Insights & Views

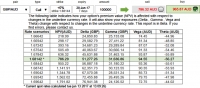

OTC Outlook and Option Strategies: Please be noted that the ATM call of 1w expiries are trading 23% more than of its NPV, while implied volatilities of 1w tenors are just shy above 9% and sliding below 8.5% for 1m...

- Market Data