FxWirePro: Driving forces of LATAM FX basket and derivatives trades roundup

Jun 19, 2017 12:29 pm UTC| Research & Analysis Insights & Views

In Brazil, reform optimism has not waned and there is increasing risk that Temer may not complete his term. USDBRL should move higher as reform optimism wanes. Economic activity should recover and the rate easing cycle is...

Jun 19, 2017 12:23 pm UTC| Research & Analysis Insights & Views

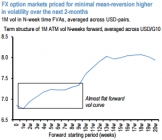

Hawkish DM monetary policy surprises this week may spur 1-2 weeks of decent realized volatility but are unlikely to be durable enough to upend placid option pricing through the summer. Option implied USD-correlations...

Fitch Revises Oman's Outlook to Negative; Affirms at 'BBB'

Jun 19, 2017 12:00 pm UTC| Research & Analysis

Fitch Ratings has revised Omans Outlook to Negative from Stable and affirmed the sovereigns Long Term Foreign- and Local-Currency Issuer Default Ratings (IDRs) at BBB. The issue ratings on Omans senior unsecured...

FxWirePro: Deploy 3m forwards on lucrative RUB correction structure

Jun 19, 2017 11:35 am UTC| Research & Analysis Insights & Views

Beware of RUB correction: Are you concerned that RUB positioning is too heavy, stagnant price action is a warning sign, fundamentals could turn, and a significant correction could happen? We are. In the recent past, weve...

Jun 19, 2017 10:09 am UTC| Research & Analysis Insights & Views

Option Trade Strategy: Buy 3m USDRUB call strike 59, Sell call strike 62 knock-in 65 Indicative offer: 1.23% (vs 1.06% for the vanilla call spread, spot ref: 56.50) The position entails buying a USDRUB 3m call strike 59...

FxWirePro: A glimpse through EMFX trading atmosphere and trading perspectives

Jun 19, 2017 08:47 am UTC| Research & Analysis Insights & Views

Increased buy-in to the carry thesis. The vast majority of US investors is bullish emerging market assets; with most participating in EM carry plays. Of note, previous holdouts who were uber-bearish EM and who have...

Jun 19, 2017 08:35 am UTC| Research & Analysis Insights & Views

Bearish scenarios: AUDUSD below 0.72 if: 1) The unemployment rate breaks above 6%, forcing the RBA to respond more aggressively to weak inflation; 2) The Fed responds to animal spirits and bullish survey data by...

- Market Data