FxWirePro: NZD/USD projections and hedging framework for 2017

Feb 02, 2017 12:29 pm UTC| Central Banks Research & Analysis

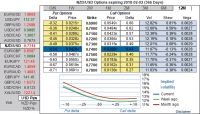

NZDUSD medium term perspectives:The month ahead could see NZDUSD extending beyond 0.7500 (Sep high) if the US dollar continues to register disappointment in the Trump Administrations policies. Further ahead, though, the...

Feb 02, 2017 12:14 pm UTC| Research & Analysis Insights & Views

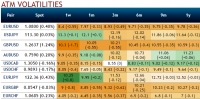

GBPCHF back-end volatility: 1Y -2Y GBPCHF straddles strike us as anexcellent defense against Brexit chaos, for a few reasons: 1) GBPCHF vols have retraced nearly all the way back to their post-referendum lows (refer...

Feb 02, 2017 12:07 pm UTC| Central Banks Research & Analysis

The US Federal Reserve maintained monetary policy unchanged last night, as broadly anticipated. The accompanying statement was a little more upbeat than before, noting the improvement in consumer and business sentiment....

Fitch: Social Spending and Cuts in State Transfers Pressure French Departments' Finances

Feb 02, 2017 10:20 am UTC| Research & Analysis

Fitch Ratings says that French departments finances have been under pressure in recent years from growing social spending, especially social benefits and social inclusion, and cuts in state transfers since 2014. This has...

FxWirePro: Stay short hedged in AUDJPY through one-touch calendar spread

Feb 02, 2017 07:00 am UTC| Research & Analysis Insights & Views Central Banks

We structured a bearish AUDJPY view through a calendar spread of one-touches (short a 3m one-touch put, long a 6m) to capture the good-bad duality in Trumps policy platform. The markets have been squarely focused since the...

FxWirePro: Options and cash trades for Swedish Krona on inspired rallies of Riksbank

Feb 01, 2017 13:30 pm UTC| Research & Analysis Insights & Views

Stay long SEK vs EUR (cash) and NZD (options) EURSEK continued its steady but nevertheless persistent decline this week as an extremely strong PPI print supported the sense that the inflation cycle in Sweden is gaining...

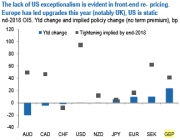

FxWirePro: Hedge commodity driven currencies amid Trumps stringent policies and NAFTA renegotiations

Feb 01, 2017 11:26 am UTC| Research & Analysis

This write up emphasizes long positions in commodity driven currencies such as NOK and shorts in CAD, we continue to indicate a surprising degree of equanimity in CAD towards Trump and the Boc and anxiety in NOK towards...

- Market Data