FxWirePro: How to hedge higher bond yield disruption in high beta EM FX crosses?

Sep 15, 2016 13:17 pm UTC| Research & Analysis

The template for a disorderly bond market rout in loose policy surroundings was provided by the Bund VaR shock last spring, whereby higher yields disrupt complacent EM longs and force sharp spikes in EUR- and JPY-EM...

Sep 15, 2016 12:00 pm UTC| Research & Analysis Central Banks Insights & Views

Lets have a glance through IVs, risk reversals, and market pin risk before we begin with the selection of right option instrument. The current ATM implied volatilities have slipped below 10% after SNB maintained status...

Sep 15, 2016 02:49 am UTC| Research & Analysis

Moodys Investors Service says that the Hong Kong legislatures passing of the Financial Institutions (Resolution) Ordinance on 22 June is an important milestone in the governments efforts to revise its financial...

FxWirePro: Short USD/BRL gamma via calendar spreads to address both RVs and IVs

Sep 14, 2016 13:05 pm UTC| Research & Analysis Insights & Views

Rare currencies where we do not mind earning the fat vols carry on offer is BRL. Front-end USDBRL vols have popped higher over the past two weeks alongside a bounce in thespot, and are once again packing in sizeable 4-5 %...

FxWirePro: USD calls and CHF puts delta-hedged ahead of SNB’s monetary policy

Sep 14, 2016 09:53 am UTC| Research & Analysis

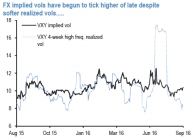

CHF is a good vol to own within G10 on gamma grounds alone (see above chart). Receptively, high-frequency realized vols have arrested their post-Brexit negative momentum and begun to turn mildly higher in August even in a...

Sep 14, 2016 08:04 am UTC| Research & Analysis Insights & Views Central Banks

In terms of sterlings currency markets, GBP crosses fell by around 1.14% yesterday versus the USD and euro but regained today slightly about 0.17%. Moves lower in the currency may be partly due to some caution/uncertainty...

FxWirePro: NZD/USD knock-out puts carry attractive risk reward ratio

Sep 14, 2016 07:08 am UTC| Research & Analysis Insights & Views

On technical grounds, we point out that last week NZDUSD has formed shooting star candlestick pattern at peaks of 16-months highs which is bearish in nature (at 0.7318 levels, see weekly chart). Diverging daily as well as...

- Market Data