Sep 26, 2016 13:27 pm UTC| Research & Analysis Insights & Views

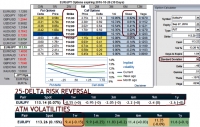

EURJPY IVs of 1w tenors have reduced to below 9.5% after BOJs shift in its monetary policy stance, while risk reversals still indicate the bearish hedging sentiments in the FX OTC markets. From these risk reversal...

FxWirePro: Uphold EUR/USD vols derivatives owing to prospects of vega outperformance

Sep 26, 2016 11:39 am UTC| Research & Analysis Insights & Views

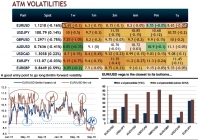

The EURUSD action, is characterised by relatively range-bound spot markets from last two years with only rupture of realised volatility, is not enough to support an imminent rise in volatility. EURUSD is the pair to...

Sep 26, 2016 08:25 am UTC| Research & Analysis

Moodys Investors Service says that the Government of Maldives B2 issuer rating and stable outlook are supported by the countrys robust growth path and strong debt affordability metrics. However, a narrowly-diversified...

FxWirePro: EUR/USD’s vega reigns at coolest spot and offers cheapest IVs among G7 FX space

Sep 26, 2016 08:16 am UTC| Research & Analysis Insights & Views

FX volatility entered a moderate regime in early 2015 but since July has come under significant pressure and is experiencing an unusually long period of stability. The current lows suggest multi-month volatility hedges, as...

Moody's: US post-election shift in trade policy poses limited overall risk for Sub-Saharan Africa

Sep 25, 2016 15:43 pm UTC| Research & Analysis

The credit implications for sovereigns in Sub-Saharan Africa (SSA) of a potential shift in the United States of America (Aaa stable) policies after the November election would materialize through trade, investment and...

Moody's: US post-election shift in trade policy would have modest impact on EU

Sep 25, 2016 15:39 pm UTC| Research & Analysis

A potential shift in policymaking following the election of a US president would have a modest impact on trade overall, says Moodys Investors Service in a report published today. Moodys report, entitled Sovereigns --...

Sep 23, 2016 09:58 am UTC| Research & Analysis Insights & Views

We know that bullish trend has again resumed and it likely to drag further to higher levels up to 1.0705 levels. Uptrend seems to be intensified especially after RBNZ stood pat in its yesterdays monetary policy, leaving...

- Market Data