FxWirePro: Overpriced 1w IVs, interest rates differentials keep NZD/USD call writers on upper hand

Sep 14, 2016 07:00 am UTC| Research & Analysis Insights & Views

1w implied volatilities are flashing at 12.61%, while ATM calls of this time frame are priced at 15.38% more than Net Present Value. Hence, these call options are deemed as overpriced in prevailing bearish...

FxWirePro: Risk reversal trades seem attractive in USD/KRW

Sep 13, 2016 13:25 pm UTC| Research & Analysis Insights & Views

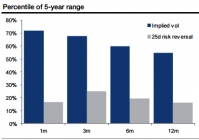

The KRW has rallied significantly in the past three months; typically this would mean sharply lower implied vol and skew. KRW implied vol (1m to 1y) is in the upper half of the 5-year range whereas 25d risk reversals...

A glimpse on US elections, 3m FX HVs and IVs

Sep 13, 2016 12:53 pm UTC| Insights & Views Research & Analysis

The US polls currently give Clinton a 2-5 point advantage over Trump. Polls also highlight a near-record lack of trust in government, which increases the risk of a surprise anti-establishment vote. In the floating...

FxWirePro: MXN cheap valuation versus crude oil, US polls and 1m-3m ATM tenors

Sep 13, 2016 08:43 am UTC| Research & Analysis Insights & Views

The MXN is around two standard deviations cheap versus oil prices as you can observe in the above chart (based on a weekly regression of FX and oil prices since 2014), while the rest of G10 and EM oil-driven currencies are...

Sep 13, 2016 06:38 am UTC| Research & Analysis Insights & Views

As the delta risk reversals of EURJPY have again shown in bullish interests as the progressive increase in positive numbers to signify the traction for short term upside sentiments in 1w expiries but no changes for further...

Moody's: Rated Chinese banks show continued negative performance trend in 1H 2016

Sep 13, 2016 00:43 am UTC| Research & Analysis

Moodys Investors Service says that the 1H 2016 results of its 12 rated listed Chinese banks showed a continued weakening in their overall performance, while some improvements were evident for new problem loan formation,...

Sep 12, 2016 11:28 am UTC| Central Banks Research & Analysis

The Australian dollar was weaker, AUDUSD continuesto slide down 0.45% at 0.7506 despite the RBA left the cash rate unchanged at 1.5% and provided little forward guidance. The Banks comments on the housing market were...

- Market Data