Jul 28, 2016 13:11 pm UTC| Research & Analysis Insights & Views

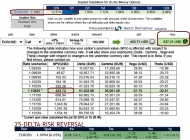

The delta risk reversals with positive changes of all time frames have alerted the major non-directional trend that has lasted since February 2015 but gradually favours downside hedging risks over the longer period of...

Jul 28, 2016 12:52 pm UTC| Research & Analysis Insights & Views Central Banks

Please have a glance IVs of Yen crosses (see highlighted portion of yen crosses), 1W ATM tenors have spiked above 22% almost all yen crosses, and this turbulence in OTC market is majorly due to tomorrows monetary policy...

Jul 28, 2016 11:21 am UTC| Research & Analysis Insights & Views

Please be noted that the ATM IVs of this EURUSD are creeping up at 7.79% and 7.12% for 1w and 1m tenors respectively. Whereas the ATM premiums are trading 24% more than NPV, the disparity between IVs and premiums are...

Jul 28, 2016 08:29 am UTC| Research & Analysis Insights & Views

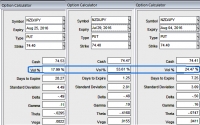

Technically, the NZD/JPY bears establish robust volume build ups in the major trend, lingering supports 7DMA which seems to be broken to evidence more slumps, we devise a hedging strategy using FX options. The execution...

Jul 28, 2016 08:06 am UTC| Research & Analysis Insights & Views Central Banks

The implied volatilities of ATM contracts for near month expiries of this the pair are spiking in sky-rocketed pace. Here are the evidences: ATM IVs of this pair is trending higher at around 53.61%, 17.99% and 24.47%...

Jul 27, 2016 13:46 pm UTC| Research & Analysis Insights & Views

Oil got a bit ahead of itself in June, breaching $50/bbl, but has since eased as some earlier supply disruptions were resolved and the market focuses on the potential for slower demand growth, an overhang of refined...

Jul 27, 2016 12:35 pm UTC| Research & Analysis Insights & Views Central Banks

The GBP versus a few major G10 currencies on Wednesday, despite upbeat Q2 GDP numbers, as the investors seem to have remained cautious ahead of the Feds monetary policy statement due later in the day and the Bank of...

- Market Data