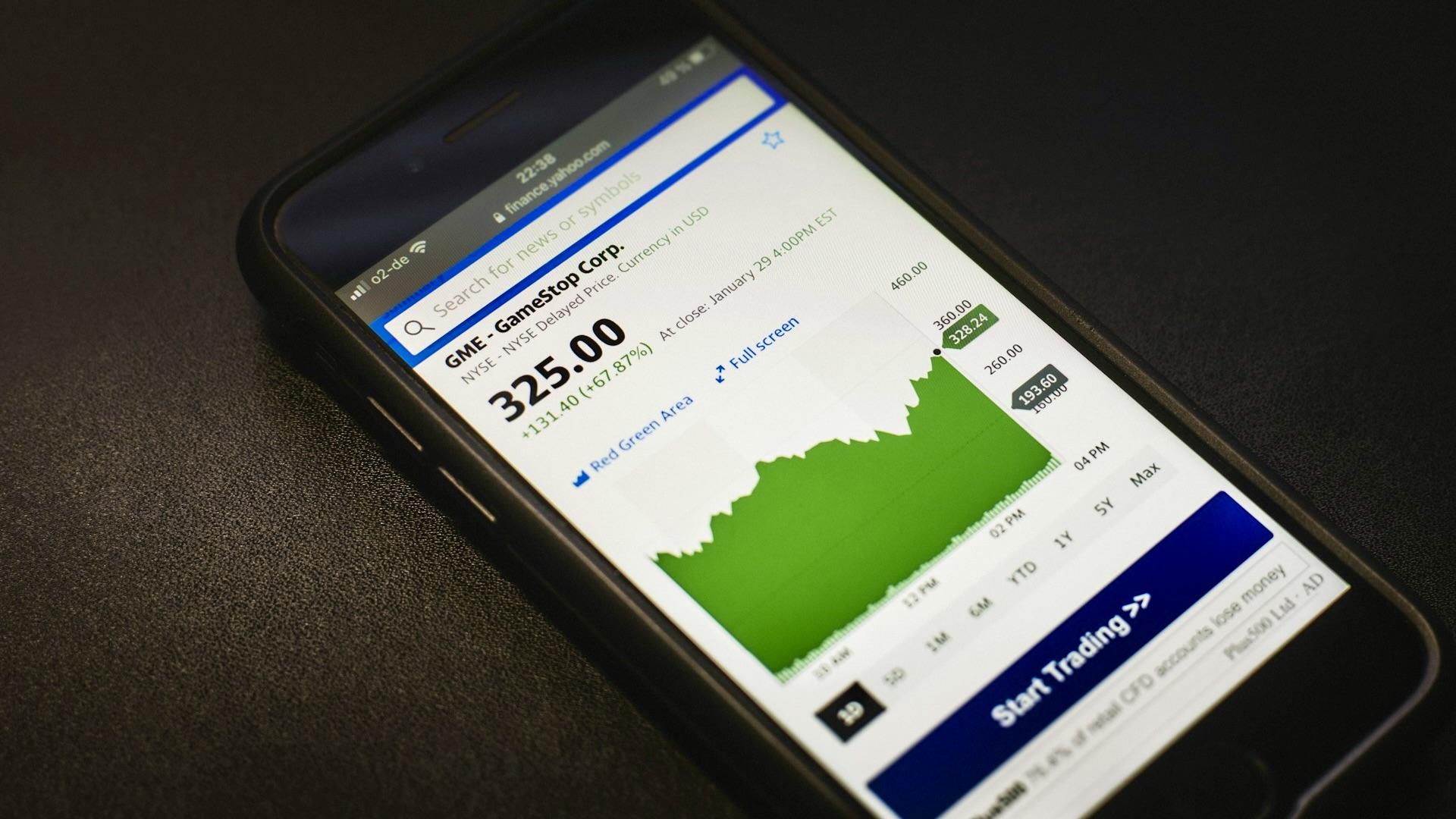

GameStop shares soared Thursday after "Roaring Kitty," the influencer behind the 2021 meme stock phenomenon, posted a cryptic image online. The stock climbed 6%, peaking at $30.87, as retail traders reignited their enthusiasm for the iconic video game retailer.

GameStop Surges as ‘Roaring Kitty’ Cryptic Post Fuels Retail Buzz

Keith Gill, a meme stock influencer who became famous for his online personalities and bullish wagers on GameStop, caused a trading frenzy among small-scale investors, and his cryptic remark on Thursday caused GameStop's shares to surge, Reuters reports.

On the social media platform X, Gill shared an image that looked like a 2006 cover of Time magazine, accompanied by a computer screen. His post caused GameStop's stock to surge, and it reached a high of $30.87. As a whole, the stock rose 6%.

During the so-called "Reddit rally" in January 2021, when GameStop stock climbed 1,600% at one time, stunning hedge funds that had bet against the videogame retailer, Gill—also known as "Roaring Kitty" on YouTube and "DeepF***ingValue" on Reddit's famous WallStreetBets—played a pivotal role.

Meme Stocks and GameStop Trading Patterns Emerge Again

According to Interactive Brokers' chief strategist Steve Sosnick, this is indicative of a trend in GameStop trading: the stock price will surge, then when it levels out or falls, Gill's "Roaring Kitty" persona will typically surface with a social media post.

"We've seen that pattern again recently; the stock was at $21 earlier in November but then rallied to $30 or so around Thanksgiving, only to give back most of those gains over the last couple of days."

Trade Alert, an options analytics business, reported that by 2:14 p.m. (1914 GMT) on Thursday, about 300,000 GameStop options contracts had changed hands, which is approximately 1.5 times the average speed.

GameStop Volatility and Options Trading Surge

According to the data, the 30-day implied volatility of the stock—a measure of how much investors anticipate the shares will fluctuate in the near future—rose to 132%, a three-week high, from 93% the previous session.

As of late afternoon, some 32,000 contracts had been traded, all wagering on the shares finishing above $30 by Friday.

Yahoo Finance shares that a flood of enthusiastic messages from Gill's followers greeted his return to social media earlier in 2024, following a three-year absence. Many of these followers compared the internet sensation to David, who confronted and defeated Wall Street's Goliaths.

Reddit Rally Legacy and Meme Stock Resurgence

"The re-emergence of the popularity of meme stocks tends to follow any general resurgence in market enthusiasm and animal spirits," said Art Hogan of B. Riley Wealth Management, a market expert. "Whenever markets are at or near all-time highs, that particular part of the speculative side of stocks tends to pop up again."

Gill initiated the 2021 meme stock surge by posting on the WallStreetBets forum about his profits from investing in the heavily shorted company.

In a coordinated effort by Redditors, pessimistic hedge funds lost billions of dollars and came under scrutiny from U.S. regulators as the rally extended to other heavily shorted firms, including AMC Entertainment.

"Dumb Money" (Craig Gillespie, 2023) is based on the whole episode.

Other Meme Stocks Join GameStop in Uptrend

Following Gill's article, other so-called meme stocks also experienced an uptick in trading on Thursday. Unity Software's stock ended the day up 5%, while AMC Theatres, another retail investor darling from 2021, had its share price rise 6%.

"It wouldn't surprise me if the faithful haven't been distracted by other things. Crypto has stolen GameStop's thunder recently," Sosnick remarked.

So far this year, the stock of the video game retailer has increased by over 76%. Meanwhile, the world's largest cryptocurrency, bitcoin, has had an unprecedented rally, with a price increase of over 130% and a breakout above $100,000 earlier on Thursday, driven by hopes for loosening regulatory restrictions.

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal