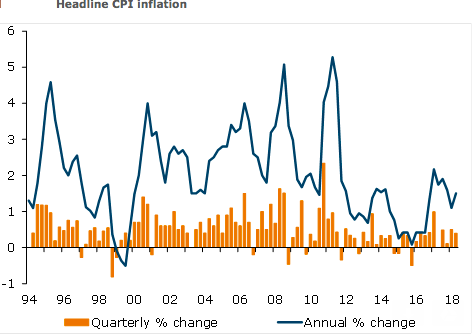

New Zealand’s second-quarter annual consumer price inflation (CPI) bounced back, albeit missing market estimates, while the q/q rate fell in comparison to the previous reading in the first quarter. Following this, the NZD/USD currency pair rose nearly 0.75 percent during European session Tuesday, trading 0.68371 at the time of writing.

Headline CPI rose 0.4 percent q/q in Q2, which was below consensus expectations (0.5 percent) and this saw annual inflation pick up to 1.5 percent y/y from 1.1 percent in Q1. Tradable prices rose 0.3 percent q/q (0.1 percent y/y), while non-tradable prices rose 0.4 percent q/q (2.5 percent y/y). It was the strength in non-tradables inflation that proved to be the biggest surprise.

But there were some offsets. Broadly as expected, the food group rose 0.8 percent q/q and petrol prices rose 3.2 percent q/q. The latter reflecting recent NZD weakness and higher oil prices. Petrol will likely make another positive contribution in Q3 given the recent lifts in fuel taxes.

The housing group remained at the fore, and despite our expectation for the recent deceleration to remain in a holding pattern, housing-related prices proved they haven’t found a limit just yet. The purchase of housing rose 1.1 percent q/q (3.9 percent y/y). This is still below the average of 1.3 percent q/q over the past three years and its peak of 6.7 percent y/y in Q1 2017.

Further, core and underlying inflation measures also strengthened slightly. The trimmed mean measures lifted across all levels of the trim in annual terms and the weighted median gained 0.3 percentage point to 2.3 percent y/y. The focus now turns to the RBNZ’s sectoral factor model estimate, which has ranged between 1.4-1.5 percent since Q3 2015.

"We expect the RBNZ will be looking for inflation to increase in a consistent, broad based way from here and will retain a neutral stance, signalling that the next move in interest rates could still be up or down, until it is confidence the underlying inflation pulse has strengthened," ANZ Research commented in its latest report.

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility