RBA to stay on hold as the risks transition

Dec 09, 2015 23:16 pm UTC| Commentary Central Banks

The RBA will likely look through any significant acceleration of tradable inflation. Any acceleration in the targeted core measure of inflation is expected to be much more modest, only returning to the midpoint of the 2-3%...

Bank of England will need to consider Brexit risks

Dec 09, 2015 22:33 pm UTC| Commentary Central Banks

The uncertainty generated ahead of the referendum may not be the perfect recipe for growth. The Bank of England will need to take that into account. For instance, the BoE said in 2012 that the most extreme potential...

Fed interest rate hike may have less of an impact than you think

Dec 09, 2015 13:53 pm UTC| Insights & Views Central Banks

There is a very high chance the Federal Reserve will raise interest rates next week. It would be the first time the Federal Open Monetary Committee (FOMC) the Feds rate-setting team has lifted its benchmark rate since...

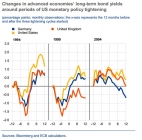

FED liftoff series – long rates rise not a certainty

Dec 09, 2015 11:22 am UTC| Commentary Central Banks

The event the world has been awaiting, preparing and speculating for is finally approaching - meeting by US Federal Reserve, in which US interest rates will finally rise from their zero bound. After Fridays super job...

Fed liftoff series – term premium might fall and aberrations

Dec 09, 2015 10:32 am UTC| Commentary Central Banks

The event the world has been awaiting, preparing and speculating for is finally approaching - meeting by US Federal Reserve, in which US interest rates will finally rise from their zero bound. After Fridays super job...

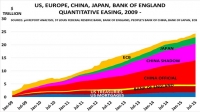

FED liftoff series – Beginning of a mega-rewind?

Dec 09, 2015 09:09 am UTC| Commentary Central Banks

The event the world has been awaiting, preparing and speculating for is finally approaching - meeting by US Federal Reserve, in which US interest rates will finally rise from their zero bound. After Fridays super job...

BOC governor Poloz points to array of available ammunition

Dec 09, 2015 08:13 am UTC| Commentary Central Banks

Bank of Canada (BOC) may have held policy steady at last meeting, the governor Stephen Poloz pointed out that the bank is not out of ammunition, instead it has more tools now than ever before ready to be deployed if deemed...

- Market Data