FxWirepPro: USD/CHF to perceive HY vols; optimize volatility through gamma spreads

Aug 07, 2015 09:46 am UTC| Insights & Views

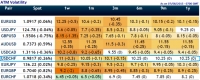

Weve been formulating a lot of call spreads on highly volatile currency pairs (USDCHF is the one among the pool, the pair ranks under top three highest among major pairs to perceive volatility of ATM contracts, ATM...

Guide to today’s important data and events

Aug 07, 2015 09:39 am UTC| Insights & Views

Lot of economic releases scheduled for today, some with high risk associated. Data released so far - Australia - Home loans grew 4.4% while investment lending foe homes dropped by -0.7% in June. Japan - Bank of...

FxWirePro: NZDUSD calendar combination for hedging on 1M HY vols

Aug 07, 2015 08:27 am UTC| Insights & Views

The pair is holding 6 years lows of NZD/USD as inverted hammer pattern candle that was occurred on weekly chart exactly at 0.6572. RSI is converging to boost up rising prices (current RSI is trending at 40.0054) while %K...

Aug 07, 2015 07:40 am UTC| Insights & Views

Technical glimpse: The inverted hammer that was spotted out in our earlier call has factored in the daily prices (see what has happened on daily chart after the formation inverted hammer). The pair was able to hold 6 years...

FxWirePro: Trade AUD/JPY with call spreads, hedge with PRBS

Aug 07, 2015 06:51 am UTC| Insights & Views

The trading call was generated with the help long bullish engulfing like pattern, positively converging leading oscillators and relevant volume confirmation. The bullish candle has broken crucial resistance at 91.311...

Inflation refrains BoJ to expand stimulus; GBP/JPY debit spreads may trend slightly up or sideways

Aug 07, 2015 06:10 am UTC| Insights & Views

Among G10 pool, sterling received a shot in the arm from hawkish BoE governor Carney, who had said that "the point at which interest rates may begin to rise is moving closer given the performance of the economy". But for...

Aug 06, 2015 18:35 pm UTC| Insights & Views

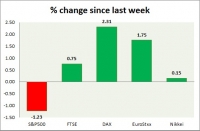

Equities are down globally ahead of FOMC. Performance this week at a glance in chart table - SP 500 - SP losing ground over massive profit booking heading into tomorrows NFP report. Todays range 2104-2075. Initial...

- Market Data