Low delta EUR/GBP put options for Greece risks

May 22, 2015 07:13 am UTC| Insights & Views

As we stated in our previous post also, although the market response towards Greece turmoil remains fragile and the EUR seems to exhibit a high beta to political developments on either side.The cash difficulty for Greece...

Asian markets almost mild to higher; Japan unchanged interest rate stimulates JPY

May 22, 2015 06:03 am UTC| Insights & Views

BoJs interest rate decision: The benchmark interest rate in Japan was last recorded at 0% which is unchanged from previous period and remains in line with consensus. Nikkei 225 index was almost flat (up 0.17%) ahead of...

Stronger IFO assessments might resume bund sell offs

May 22, 2015 05:47 am UTC| Insights & Views

Today German IFO assessments are to be released around 8:00 GMT. Past trends - Germanys resilience during 2008 crisis have pushed IFO assessments (Expectations. Business Climate and Current assessment) have pushed...

Stronger German GDP might push Euro and yields to upside

May 22, 2015 05:21 am UTC| Insights & Views

Traders are awaiting first quarter GDP release from Germany at 6:00 GMT. Past trends - After 5% y/y growth in first quarter of 2011, growth had slowed down sharply over the Euro zone debt crisis to -1.6% in first...

Guide to today’s important data and events

May 22, 2015 05:18 am UTC| Insights & Views

Lot many economic dockets scheduled with high risk associated along with speeches from Central Bankers. Data released so far - China - Conference board leading economic index improved to 1.1 in April from...

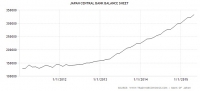

BOJ to sit tight and hold policy steady

May 21, 2015 15:59 pm UTC| Insights & Views

Bank of Japan (BOJ) will announce its monetary policy decisions tomorrow sometime in early Asian hours. Speech by Governor Kuroda is scheduled at 3:00 GMT. Current monetary policy - BOJ is holding policy rates near...

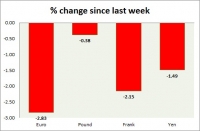

Currency snapshot (major pairs)

May 21, 2015 15:13 pm UTC| Insights & Views

Dollar index trading at 95.34 (-0.27%). Strength meter (today so far) - Euro +0.08%, Franc -0.07%, Yen -0.02%, GBP +0.79% Strength meter (since last week) - Euro -2.83%, Franc -2.15%, Yen -1.49%, GBP -0.38% EUR/USD...

- Market Data