FxWirePro: Discovery of long Vega hedges via cheap FVA spreads

Mar 21, 2018 10:13 am UTC| Research & Analysis Insights & Views

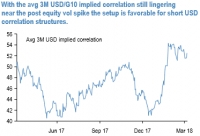

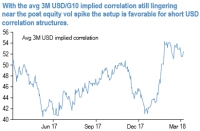

The lack of many reactions from the likes of Antipodeans and loonie fetches out prospects to buy underpriced hedges via optionality. Most noticeably, aggregate USD-denominated implied correlations still trade near their...

FxWirePro: USD/KRW lucrative Theta themes for Double-No-Touch structures

Mar 21, 2018 08:24 am UTC| Research & Analysis Insights & Views

The trade protectionism theme that took place last week, shot back into focus as a potential major left tail risk for markets which got further aggravated by the subsequent retaliatory rhetoric from Europe and Asia....

Mar 21, 2018 06:03 am UTC| Research & Analysis Insights & Views Central Banks

The two main events this week though are the FOMC meetingon Wednesdayand the BoE meetingThursday. In regards to the former, the Fed is fully expected to raise rates by 25bps, but the focus will be on the message from the...

FxWirePro: Delta-hedging for yellow metal price risks on lingering FOMC’s hiking risks

Mar 20, 2018 13:48 pm UTC| Research & Analysis Central Banks

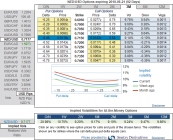

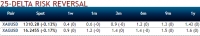

The yellow metal price would usually be sensitive to moves in both UST rates and USD. The gold prices would be more expensive for holders of foreign currency on the robustness of dollar, while a rise in U.S. rates lifts...

Mar 20, 2018 12:28 pm UTC| Research & Analysis Insights & Views

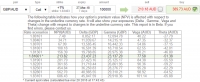

Hedging strategy: 3-Way Options straddle versus Call Spread ratio: (Long 1: Long 1: Short 1) The execution: Initiate long in GBPAUD 1M at the money -0.49 delta put, long 1M at the money +0.51 delta call and...

Mar 20, 2018 12:25 pm UTC| Research & Analysis

The rate of inflation across the UK dropped to 2.7% in February 2018 from 3% in the previous month and below market expectations of 2.8%. It was the lowest rate since July last year, as prices increased at a softer pace...

Mar 20, 2018 09:37 am UTC| Research & Analysis Central Banks Insights & Views

The drivers of the dollars expected medium-term grind weaker in the refreshed forecasts are largely the same ones as we originally outlined in our recent post although the trade-weighted dollar Index has gone up by 0.2%...

- Market Data