FxWirePro: EUR/TRY options seems turbo-charged versions of USD/TRY amid eruption of vols

Nov 10, 2017 13:24 pm UTC| Research & Analysis Insights & Views

The upshot of this muted vol response is that carry/vol ratios in TRY options have risen to stratospheric levels reminiscent of the pre-Lehman08 period. At current prices, 1Y ATMF USDTRY straddles are self-financing...

FxWirePro: Hunt for Gamma ownership ends in EUR/NZD

Nov 10, 2017 13:01 pm UTC| Research & Analysis Insights & Views

Gamma ownership in EUR and USD against EMFX space is rendering lucrative options on central bank meetings (c.f. BoE), and in vega-neutral steepener format along steep vol curves. EURNZD gamma is still good value on...

FxWirePro: Fair interpretation on VXY of G10 FX in snail’s pace

Nov 10, 2017 11:23 am UTC| Research & Analysis Insights & Views

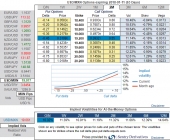

Lets glance through the above nutshell thats showing ATM IVs of G10 pairs which are lower side. Despite a mild pick up in IV rise, all the pairs are still displaying below 8% except USDJPY. This lackluster move is to be...

FxWirePro: Glimpse through APAC central banks’ guidance and hedge AUD/NZD via options strips

Nov 10, 2017 08:12 am UTC| Research & Analysis Insights & Views Central Banks

The RBAs forecasts have been updated with the publication of the November Statement on Monetary Policy (SoMP). The growth outlook is little changed and the unemployment rate is expected to fall to 5¼% by Dec...

FxWirePro: Short hedge for short-term USD/MXN traders as Banxico to line up with dovish league

Nov 09, 2017 13:18 pm UTC| Central Banks Research & Analysis Insights & Views Technicals

Tonight the Mexican central bank will leave its key rate unchanged at 7% once again. The fall in GDP in Q3 is due to the earthquake and tornados so that there is no reason for the central bank to react to the GDP data with...

FxWirePro: Hedge USD/MXN via 3-way straddle as monetary policy seems non-event for peso vols

Nov 09, 2017 13:15 pm UTC| Central Banks Research & Analysis Insights & Views

The Mexican central bank will likely leave its key rate unchanged at 7% once again, the meeting is unlikely to provide any surprises and should, therefore, be a non-event for the peso. Please be noted that the current...

Nov 09, 2017 12:28 pm UTC| Research & Analysis Insights & Views

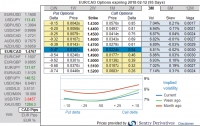

Technically, EURCAD has been drifting in the range between 1.5258 - 1.4442 from the last couple of months. We foresee the trend is likely to hover in the similar range but certainly not any dramatic spikes. Refer below...

- Market Data