Jul 06, 2017 11:49 am UTC| Research & Analysis Insights & Views

Bullish and bearish scenarios of USDMXN: Bullish scenario: USDMXN could be seen at 20 over 2H17 on a putative disorderly renegotiation of NAFTA, de-anchoring inflation expectations leading to bond outflows and local...

FxWirePro: Relative value options trades for EURUSD amid bullish neutral risk reversals

Jul 06, 2017 09:12 am UTC| Research & Analysis Insights & Views

The focus in the euro area today will be the account from the ECBs June Governing Council meeting which will be analyzed for any further insight into the likely timing of the ECBs announcement of a gradual tapering....

FxWirePro: Formulate knock out optionality structure for USD/CAD bearish potential

Jul 05, 2017 11:43 am UTC| Research & Analysis Insights & Views Central Banks

The bearish USDCAD scenarios (below 1.28) driven by: BoC indicates an intention to normalize rates earlier due to an improved global outlook. Global demand pushes oil prices to $50 plus and towards $60. The...

Jul 04, 2017 12:33 pm UTC| Research & Analysis Insights & Views

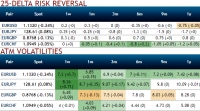

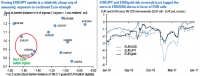

EUR vol risk reversals remain low compared to the level of rates (refer above diagram). Also, in longer tails, the EUR volatility smile remains flat compared with the rates vs vol correlation seen since 2015 and over the...

Jul 04, 2017 10:43 am UTC| Research & Analysis Insights & Views

WTI crude prices have been inching higher towards $47 ahead of tomorrows EIAs inventory check, today the rallies seem to be little edgy snapping eight days of gains in what was the longest unbroken rally in more than five...

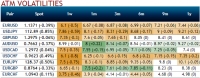

FxWirePro: RVs versus IVs in G7 FX space, what has low vol in it?

Jul 04, 2017 09:30 am UTC| Research & Analysis Insights & Views

Weve seen the H12017 has turned out to be one dominated by USD weakness, and the outperformance of EM carry, an outcome expected by few at the beginning of the year. FX vols enter H2 meaningfully cheap versus macro...

FxWirePro: Luring Lonnie’s optionality - USD/CAD unlikely to hit 1.23 knocks out from above 1.32

Jul 04, 2017 07:56 am UTC| Research & Analysis Insights & Views

Even the sharp renewed decline in the broad dollar is well explained by the fact that the US largely sat out of the rates repricing phenomenon that took hold of large parts of the rest of the G10 universe. The end result...

- Market Data