Jul 04, 2017 07:24 am UTC| Research & Analysis Insights & Views

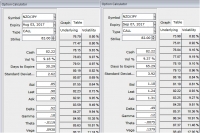

The Reserve Bank of New Zealand kept its official cash rate unchanged at record low of 1.75 percent on June 21st, 2017, as widely expected. The central bank left the monetary rate unchanged for the fourth straight meeting....

Jul 04, 2017 04:03 am UTC| Research & Analysis

Moodys Investors Service says that the ongoing development and other positive attributes of the Singapore covered bond market support the refinancing of covered bonds in the event of issuer default. Following a review of...

Jul 04, 2017 00:44 am UTC| Research & Analysis

Ghanas B3 credit rating and stable outlook reflects its strong economic growth outlook and reduction in external imbalances, set against challenges which include a significant fiscal overrun in 2016, high government debt...

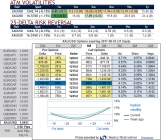

FxWirePro: A glimpse through EMFX and derivatives trades perspectives

Jul 03, 2017 13:16 pm UTC| Research & Analysis Insights & Views

EMEA EM FX weakness seems to be modest. We project modest EMEA EM FX weakness, as well as market volatility and risk premia, rise in response to changing global monetary policy narrative. Importantly for investors, we...

FxWirePro: Is it sense of optimism from China for industrial metals?

Jul 03, 2017 12:52 pm UTC| Research & Analysis Insights & Views

Having bottomed out in early 2016 after five successive years of falls, the metals index (LMEX) has rebounded by around 35%. With the exception of nickel, uptrends remain in place for most metals. We highlight several...

Jul 03, 2017 12:23 pm UTC| Research & Analysis Insights & Views

Gold price seems to be the consistent standout under an investor positioning mean reversion rule with a success ratio of over 60% over the last five years and modest average monthly returns, albeit with a low information...

FxWirePro: What drives bullish dollar again in H2’2017 – low beta formats

Jul 03, 2017 09:36 am UTC| Research & Analysis Insights & Views

The US dollar index closedFridayunchanged on the day.The H12017 turned out to be one dominated by USD weakness, and the outperformance of EM carry, an outcome expected by few at the beginning of the year. The broad slide...

- Market Data