Jul 26, 2018 07:20 am UTC| Digital Currency Research & Analysis Fintech Insights & Views Commentary

Bitcoin futures offer an instant, cost-effective method of crypto trade markets. They are standardized contracts to buy or sell a particular asset at a set price, on a set date in the future, in predefined quantity and...

Jul 25, 2018 13:04 pm UTC| Research & Analysis Insights & Views

The cable extended a comprehensive recovery, although appears to be minor that we have seen over the last couple of days, especially after PM May hinted she and her office would take over the negotiations with...

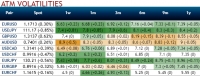

FxWirePro: Spot on FX options analytics - Divergence in EM - G10 FX vols

Jul 24, 2018 13:00 pm UTC| Research & Analysis Insights & Views

The valuation of FX derivative securities significantly depends on the market participants expectation of future volatility. Thus implied volatility often garners as much attention as the option price in option listings,...

FxWirePro: Option trades for resilient Scandis that seem undervalued against euro’s robustness

Aug 24, 2017 10:48 am UTC| Research & Analysis Insights & Views

The spring sell-off in NOK has been reversed, but NOK bulls need further evidence of improving fundamentals before taking action. We see the continued recovery of the Norwegian economy and base effects lifting inflation...

FxWirePro: What drives laggards of EMFX carry trades?

Aug 02, 2017 11:32 am UTC| Research & Analysis Insights & Views

We reiterate our bullish view on EMFX, and mark-to-market our forecasts to preserve outperformance relative to the forwards and consensus. In our Year Ahead Outlook, we projected that the bottom in EM FX would be in Q1. We...

Aug 02, 2017 11:13 am UTC| Research & Analysis

After earlier gains today, USDCNY continues to trend lower again by trimming price from the peaks of 6.7277 levels, breaching below 6.7101 (21-DMA) would attract more bearish potential. The central bank keeps setting the...

FxWirePro: Cost-effective optionality structure to arrest a RUB correction

Jun 29, 2017 12:43 pm UTC| Research & Analysis Central Banks Insights & Views

The CBR remains s dovish. We expect the measured pace of rate cuts beginning in June. May CPI at 4.1% oya surprised on the upside and is marginally above the inflation target of 4.0%. As our base case, JPM forecasts the...

- Market Data