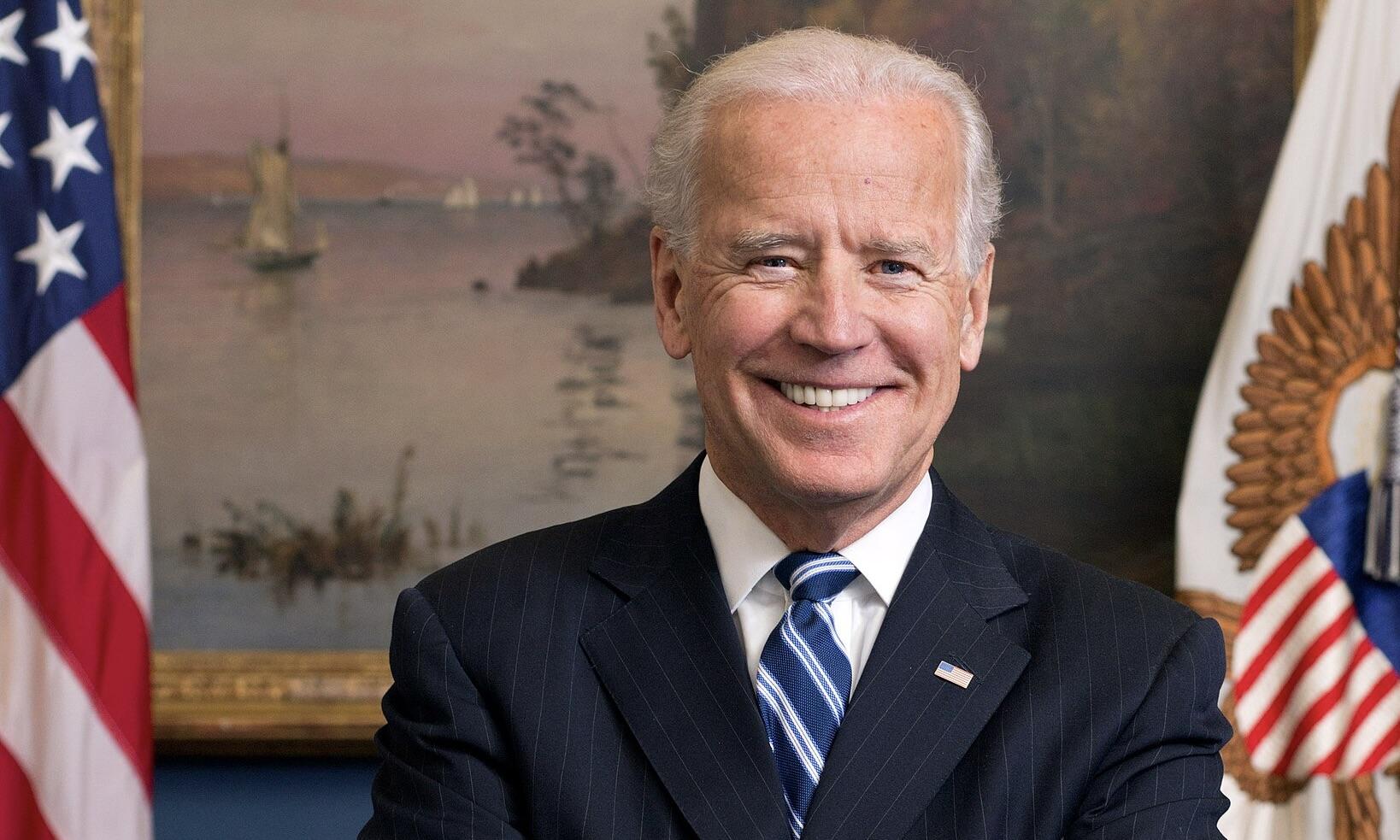

With the clock ticking on President Joe Biden's term, nearly 80 Democratic lawmakers have called on the administration to take immediate steps to forgive the debts of student borrowers, particularly those defrauded by predatory for-profit colleges. In a letter to Secretary of Education Miguel Cardona on Tuesday, legislators outlined three specific actions to address the ongoing student debt crisis.

The move comes as concerns grow over the incoming administration’s plans to overhaul federal education policies, potentially jeopardizing debt forgiveness initiatives that could benefit millions of Americans.

A Plea for Defrauded Borrowers

Democratic lawmakers, including Senators Bernie Sanders and Kirsten Gillibrand, focused on the plight of borrowers still burdened by debts from institutions with a documented history of misconduct. Many of these borrowers were low-income students, veterans, or first-generation college attendees lured by false promises of high-quality jobs and financial stability.

“Too many student borrowers have been preyed on by predatory schools, most of which are for-profit colleges,” the letter stated. “Debt has forced many of these borrowers to put their economic lives on hold, forgoing buying homes and starting families.”

The lawmakers urged the Department of Education to follow through on its borrower defense program, which promised loan discharges for victims of fraudulent institutions like ITT Technical Institute, the University of Phoenix, and DeVry University. Despite previous announcements to clear debts for over 1.2 million borrowers, recent filings reveal that a significant number have yet to see their loans forgiven.

The Growing Urgency

The Democrats’ letter also highlighted concerns about approximately 50 additional for-profit schools accused of fraudulent practices. Lawmakers asked Biden to extend forgiveness to borrowers from these institutions, citing “substantial evidence of misconduct.”

With President-elect Donald Trump preparing to take office, Democrats fear student loan forgiveness efforts may stall indefinitely. Trump has previously vowed to dismantle the Department of Education and has a controversial history with for-profit education through Trump University, which faced fraud allegations and a $25 million settlement.

Finance expert Kevin Thompson emphasized the stakes, saying, “If action is not taken under the current administration, it is unlikely to succeed under a future one, as a new administration may prioritize limiting government spending.”

Borrowers and Experts Speak Out

The student debt crisis affects more than 42.8 million Americans, with a collective balance exceeding $1.6 trillion. Advocates for student loan forgiveness, including financial literacy instructor Alex Beene, argue that the current administration must act swiftly.

“Regardless of your feelings on broader student loan forgiveness, this step is the right one for Washington to take,” Beene said. “The easiest way to resolve these issues is to forgive the debt and move on.”

Netizens on social media reacted with a mix of support and skepticism:

- @DebtReliefNow: “Biden has a chance to truly change lives—this isn’t just about politics; it’s about humanity.”

- @CollegeScamExposed: “Finally, people are talking about these fraudulent schools! It’s about time students get justice.”

- @TaxpayerBlues: “Who’s paying for this? The hardworking middle class gets left holding the bag—again!”

- @EduReformNOW: “Trump dismantling the Department of Education? Disaster incoming. Action needed NOW.”

- @ForgiveItAll: “Student debt is an anchor dragging down our entire economy. Do the right thing, Biden!”

- @RealistRants: “Forgive debt for fraudulent schools, sure. But broad forgiveness? Be real, it’s unfair to everyone else.”

Biden’s Track Record and Next Steps

During his presidency, Biden has forgiven over $28 billion in student loans for around 1.6 million borrowers, primarily targeting those defrauded by predatory institutions. However, experts warn that further inaction could leave many borrowers without relief, particularly as the incoming administration appears unlikely to prioritize such measures.

Thompson underscored the importance of urgency, stating, “These measures would provide much-needed relief to millions of borrowers who were defrauded by predatory institutions. Without action now, borrowers could face indefinite delays or outright denial of forgiveness.”

Trump Says U.S. Attacks on Iran Will Continue, Warns of More American Casualties

Trump Says U.S. Attacks on Iran Will Continue, Warns of More American Casualties  HHS Adds New Members to Vaccine Advisory Panel Amid Legal and Market Uncertainty

HHS Adds New Members to Vaccine Advisory Panel Amid Legal and Market Uncertainty  U.S.-Israel Strike on Iran Escalates Middle East Conflict, Trump Claims Khamenei Killed

U.S.-Israel Strike on Iran Escalates Middle East Conflict, Trump Claims Khamenei Killed  U.S. Deploys Tomahawks, B-2 Bombers, F-35 Jets and AI Tools in Operation Epic Fury Against Iran

U.S. Deploys Tomahawks, B-2 Bombers, F-35 Jets and AI Tools in Operation Epic Fury Against Iran  Trump Announces U.S. Strikes on Iran Navy as Conflict Escalates

Trump Announces U.S. Strikes on Iran Navy as Conflict Escalates  Iran Supreme Leader Ayatollah Ali Khamenei Killed in Israeli, U.S. Strikes: Reuters

Iran Supreme Leader Ayatollah Ali Khamenei Killed in Israeli, U.S. Strikes: Reuters  Trump Says U.S. Combat Operations in Iran Will Continue Until Objectives Are Met

Trump Says U.S. Combat Operations in Iran Will Continue Until Objectives Are Met  Australia Rules Out Military Involvement in Iran Conflict as Middle East Tensions Escalate

Australia Rules Out Military Involvement in Iran Conflict as Middle East Tensions Escalate  Does international law still matter? The strike on the girls’ school in Iran shows why we need it

Does international law still matter? The strike on the girls’ school in Iran shows why we need it  Russia Signals Openness to U.S. Security Guarantees for Ukraine at Geneva Peace Talks

Russia Signals Openness to U.S. Security Guarantees for Ukraine at Geneva Peace Talks  Trump to Address Nation as U.S. Launches Strikes in Iran, Axios Reports

Trump to Address Nation as U.S. Launches Strikes in Iran, Axios Reports  Israel Declares State of Emergency as Iran Launches Missile Attacks

Israel Declares State of Emergency as Iran Launches Missile Attacks  Zelenskiy Urges Change in Iran After U.S. and Israeli Strikes, Cites Drone Support for Russia

Zelenskiy Urges Change in Iran After U.S. and Israeli Strikes, Cites Drone Support for Russia  EU Urges Maximum Restraint in Iran Conflict Amid Fears of Regional Escalation and Oil Supply Disruption

EU Urges Maximum Restraint in Iran Conflict Amid Fears of Regional Escalation and Oil Supply Disruption  Macron Urges Emergency UN Security Council Meeting as US-Israel Strikes on Iran Escalate Middle East Tensions

Macron Urges Emergency UN Security Council Meeting as US-Israel Strikes on Iran Escalate Middle East Tensions  Israel Strikes Hezbollah Targets in Lebanon After Missile and Drone Attacks

Israel Strikes Hezbollah Targets in Lebanon After Missile and Drone Attacks  Suspected Drone Strike Hits RAF Akrotiri Base in Cyprus, Causing Limited Damage

Suspected Drone Strike Hits RAF Akrotiri Base in Cyprus, Causing Limited Damage