Feb 22, 2017 10:46 am UTC| Economy Research & Analysis Insights & Views

The Turkish lira has staged a notable recovery in the past month. In our view, this has been driven largely by a turnaround in the risk appetite for EM assets as markets shrugged off Trumpflation worries. The central bank...

Feb 22, 2017 07:51 am UTC| Research & Analysis Insights & Views

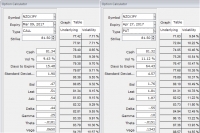

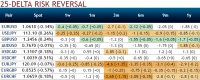

OTC updates and hedging framework: Please be noted that the 2m IVs are trading at around 11.12%, while 2w IVs are around 9.43%. In NZDJPY, if youre askeptic on ongoing rallies to have a restricted upside potential...

FxWirePro: Recovery in Czech Q4 fundamentals, Can CNB exit FX floor? Stay short in EUR/CZK

Feb 21, 2017 13:30 pm UTC| Research & Analysis Insights & Views

We estimate a modest 2.0% QoQ SAAR rebound in GDP growth (from 0.9% in Q316). Output in the industrial sector accelerated by 9.9% QoQ SAAR after a holiday distorted -7% QoQ SAAR contraction likely adding the largest...

FxWirePro: Russian central bank and government authorities send hints to uphold USD/RUB call spreads

Feb 21, 2017 12:15 pm UTC| Research & Analysis Insights & Views Central Banks

In Russia, there have been comments from officials this week following RUBs recent appreciation. Despite the onset of CBR FX purchases of around $2bn per month, the ruble has appreciated on the back of resilient oil...

Feb 21, 2017 11:40 am UTC| Research & Analysis Insights & Views

The benchmark interest rate in Singapore was last recorded at 0.46 pct. While the Fed looks through the rise in prices, the real exchange rate would appreciate. A week that delivered hawkish Fed testimony and a solid...

FxWirePro: Uphold USD/SGD “Interest Rate Swaps” owing to Federal Reserve’s developments

Feb 21, 2017 10:15 am UTC| Research & Analysis Insights & Views Central Banks

If the Fed looks through the rise in prices, the real exchange rate will appreciate. The increased inflation due to tighter labor markets would also tend to increase the real exchange rate, though this almost certainly...

Feb 21, 2017 09:39 am UTC| Research & Analysis Insights & Views

Technically, AUD remained in ranging mode, mostly between 0.7747 and 0.7162 in short term. Remains contained in a consolidative range of 0.7162-0.7874 levels. For more readings on our recent our technical write up,...

- Market Data