Feb 20, 2017 07:21 am UTC| Research & Analysis

In recent times, we upheld our long gold trade recommendation ahead of the largely uncertain risks around Trumps inauguration and the kick-off of his presidency. Obviously, both those immediate catalysts have passed but...

Feb 20, 2017 06:05 am UTC| Research & Analysis Insights & Views

Despite GBPJPY downtrend seems to be intact, a lot of bad news is already priced in and digested by the market, preventing it from being overly bearish. Brexit caused two Sterling debacles, first in June with the vote and...

Moody's: World Bank's financial position remains robust due to strong capital base

Feb 20, 2017 01:49 am UTC| Research & Analysis

The financial position of the International Bank for Reconstruction and Development (IBRD or World Bank, Aaa stable) remains robust reflecting a strong capital base and liquidity position and substantial protection from...

Feb 17, 2017 12:46 pm UTC| Research & Analysis Insights & Views

Earlier in January, we closed our long gold trade recommendation in order to lock in profits ahead of the largely uncertain risks around Trumps inauguration and the kick-off of his presidency. Obviously, both those...

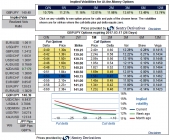

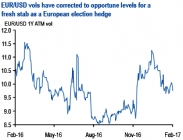

Feb 17, 2017 12:30 pm UTC| Research & Analysis Insights & Views

We believe that political risk into the French elections is priced more appropriately in bonds (but not in currencies) than going into the Brexit and US vote. In the remote scenario of a Le Pen Presidency with...

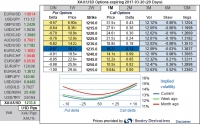

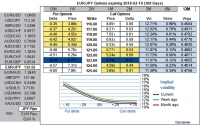

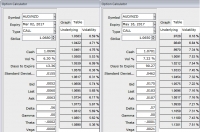

FxWirePro: Derivatives trades to short exorbitant EUR/JPY skew

Feb 17, 2017 09:34 am UTC| Research & Analysis Insights & Views

The EURJPY volatility surface is currently offering very attractive opportunities, as ATM volatility is rich and 6m/1y skews are excessively priced. Here, we recommend a couple of trades taking advantage of both the...

Feb 17, 2017 09:29 am UTC| Research & Analysis Insights & Views

AUDNZD is consolidating in a 1.0630-1.0710 range ahead of an eventual push higher. The pair in medium term perspectives:Higher to the 1.0770-1.0650 area at least. Majorly for valuation reasons, the cross remains well...

- Market Data